Key Takeaways

- Filing the Annual Return (Form NAR1) is a compulsory requirement for all Hong Kong private companies.

- Companies have a strict 42‑day filing window starting from their incorporation anniversary.

- The 42‑day period counts all days, including Sundays and public holidays.

- Late filing for Annual return can reach up to a penalties of HK$3,480, depending on how overdue the submission is.

A company shall prepare its annual return form NAR1 to the Hong Kong Company Registry every year. The filing due date is within 42 days after the anniversary date of company incorporation. Business owners shall note that no time extension will be given for filing and it is an offence for not delivering the return on time.

What is an Annual Return (form NAR1)?

In many countries, the term “annual return” refers to tax filing, but in Hong Kong, it means something entirely different. The Hong Kong Annual Return (Form NAR1) is a statutory corporate filing that updates the Companies Registry on your company’s key structure and governance details, not your tax information.

Form NAR1 includes essential information such as your registered office address, directors, shareholders, share capital, and company secretary. It must be signed by a director, company secretary, manager, or authorised representative, and filing it is a legal requirement under the Hong Kong Companies Ordinance.

Submitting your return on time does more than keep you compliant. An accurate and up‑to‑date NAR1 strengthens your company’s credibility with banks, investors, and business partners. It signals strong corporate governance, a key factor for opening bank accounts, securing investment, and maintaining trust in Hong Kong’s business environment.

When to File the Annual Return?

When a company submits its form NAR1, a prescribed government registration fee of HK$105 must also be included on the delivery of the annual return. The filing due date is within 42 days after anniversary date of company incorporation. Sundays and public holidays are also calculated in this 42 days period. Nevertheless, if the 42nd day falls on a Sunday or public holiday, the Hong Kong Company Registry will extend the due date to the following working day which is neither a Sunday nor a public holiday.

Business owners shall note that no time extension will be given for filing and it is an offence for not delivering the return on time. When the document is delivered late, Registrar will impose different layer of late fee that is up to HK$3480. The Company Registry makes no discretion on the amount of annual registration fees payable.

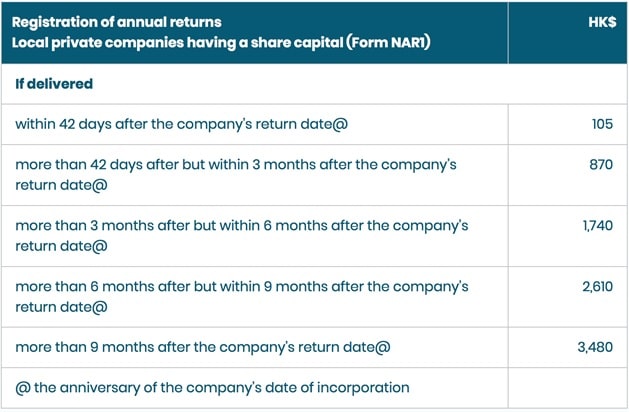

How Much is the Annual Return Fee?

The registration fee is only HK$105 when the form NAR1 is delivered on time. If the document is a late filing, the registration fee will be up to HK$3480 (refer to Figure A). Company owners who have particular concerns or those who want to save cost and comply with company regulations, you can enroll in our e-Reminder Service. This service is included in our deluxe and premium offshore company formation package. We can guide you in preparing the form NAR1 for free. So our existing clients need not worry about missing the deadline. You can subscribe for our e-reminder service by contacting our maintenance team at info@getstarted.hk. The service is free of charge and subscribers shall receive an email notification on the anniversary date of incorporation.

Who is Required to File the Annual Return?

All private companies in Hong Kong are required to file the NAR1 form with the Companies Registry within the 42-day grace period. Whether there are changes or not to the company particulars, all companies must file the Return document. This obligation stretches to incorporated entities, including public and limited by guarantee companies, though the deadlines and requirements may be different for each unique entity. The company secretary will often be in charge of preparing and filing the annual return to the Companies Registry.

Only dormant companies are exempted from filing. Though in order for a company toacquire the dormant status, proper procedure must be followed. All active companies should verify their obligations under the Companies Ordinance to avoid penalties and ensure ongoing compliance.

Annual Return Individual Submission Reminders

While our company maintenance team can prepare and submit documents to the Companies Registry on your behalf, some business owners may choose to deliver documents themselves. Below are twelve important tips we’d remind you during your own filing:

| 12 Important Tips |

|---|

| Pay sufficient postage fee if filing is done by post. |

| Insufficient postage fee will render the document “unsatisfactory”. |

| Government fee varies for different type of document filing. You shall pay the correct fee by cheque. |

| Incorrect fee will render the document “unsatisfactory”. |

| Unsatisfactory document will not be processed. Daily fine may incur for late filing. |

| You must submit the original signed documents (wet signatures). |

| E-signatures and duplicate copies are not accepted. |

| Remove any pencil remarks before submission. |

| Prepare specified forms in full. Do not remove unused pages. |

| Do not alter position of any boxes in specified forms. Forms can be rejected. |

| Use white colour A4 paper for the cover page. Filing stamp is only visible on white paper. |

| Presenter’s details shall be listed at the bottom left corner on first page for easy communication. |

Companies and their administrators are responsible to comply with their obligations to deliver this important form NAR1 to Company Registry under the Companies Ordinance for registration. We highly recommend companies to plan ahead and make their own arrangements (e.g. subscribe our e-Reminder service) to deliver the document on time.

Frequently Asked Questions

1. What is the annual return in Hong Kong?

The Annual Return (Form NAR1) is a mandatory yearly document filed with the Companies Registry to update essential particulars like your company’s directors, shareholders, and registered address. Filing this return maintains your compliance with the Hong Kong Companies Ordinance and proves your company’s active status to banks and stakeholders.

2. When is the grace period for the annual return?

The grace period for filing is strictly 42 days starting from the anniversary date of your company’s incorporation. No time extensions are granted, and this 42-day window includes weekends and public holidays.

The standard government registration fee is HK$105 if the return is submitted within the 42-day grace period. If you miss this deadline, the fee increases significantly based on the delay, with penalties reaching up to HK$3,480. In certain circumstances, the case can even be escalated to the Magistrates Court, and Court fine will apply.

4. Who is required to file the annual return?

All private companies in Hong Kong are required to file an Annual Return every year, even if there have been no changes to the company’s information. The only entities exempted from this requirement are companies that have officially declared dormant status according to proper legal procedures.

Start Your Hong Kong Company

- 0% Corporate Tax for Offshore Profit.

- 0% Value Added Tax (VAT).

- 0% Capital Gain Tax.

Guaranteed Bank Account Opening

- 100% Successful Rate For Company Registration.

- We offer real solutions to open bank account in Hong Kong.

Company Secretarial Service

Our comprehensive support which allows your company to operate efficiently without physical presence in Hong Kong.

Registered Business Address

Our company formation packages include a registered address service prepared for you hassle-free.