Key Takeaways:

- Deregistration in Hong Kong is usually carried by professional accounting firm like Get Started HK or legal firms in Hong Kong, must be approved by two government bodies.

- All shareholders and members must agree to the deregistration in Hong Kong.

- You may need to prepare and submit audited financial report to the Inland Revenue Department for company deregistration in Hong Kong

When & Why do you need Deregistration in Hong Kong?

Starting a business in Hong Kong is an exciting experience. However, if the business plan does not work out, what are the options? One of the simplest ways to close a company is to initiate the deregistration process. The application must be approved by both the Inland Revenue Department and the Hong Kong Company Registry. Once the Inland Revenue Department issues the “no objection notice” to the application, the Company Registry will then publish a close down notice in the Gazette. From our experience, it usually takes around 6 months to close a company in Hong Kong.

There are several conditions that the company must meet to apply for the deregistration:

- All members of the company must agree to the de-registration

- The company has either never started operation or has not been carrying on any business activities 3 months before the application

- The company has no outstanding liabilities

- The company is not under in any legal proceedings

- The company will not start or resume business in the future

- The company has disposed all the trading stock and securities

- Assets of the company do not consist of any immovable property situate in Hong Kong.

- The company has no other outstanding tax liabilities which include profit tax, property tax, business registration fee, stamp duty, fines or penalties.

Government Procedure of Deregistration in Hong Kong

Deregistration in Hong Kong can be applied by either a shareholder or a director of the company. The applicant company is required to remain in good standing status, which means the company must have a clean record, file and pay out all the outstanding government fees. The company must also continue to observe its obligations under the Companies Ordinance until it has been fully dissolved in the entire 6-months period.

In a situation that the company fails to comply or carry outstanding items, the company will be liable to prosecution, and the government may not grant any discretion or even discontinue the application. Nevertheless, the company applicant can only re-submit the application for completion of the outstanding notification as soon as it clears all the outstanding matters or liabilities. There is no need to pay additional fee on the re-submission.

Once the Inland Revenue Department approves the application, they will issue a “Notice of No Objection to a company being deregistered (“NNO”). Then the applicant company shall bring this notice to Company Registry and finalize within 3 months from the issuance date of NNO. Failure to do so may result in delays or rejections of deregistration. At the last stage, the Gazette Notice will be published in about 3 weeks after the date of Company Registry acknowledging receipt of the application with NNO. You may view the Gazette at the website of the Government Logistics Department. If there are no other objections from any parties, the company will successfully complete the Deregistration in Hong Kong.

If the company applies for Deregistation in Hong Kong, does it need to submit audited account to support its Profit Tax Return?

Once the company applies for deregistration in Hong Kong, Inland Revenue Department will request the company to file the last profit tax return including the cessation date of business. The company must submit audited accounts prepared by HKCPA to support its profit tax return form. Unless it is a dormant company, i.e. the company has no accounting transaction during the account period, then it is not required to file the audited account. Please note that under section 758(1) of the Companies Ordinance, every director of the company before the company dissolution must ensure all business records and papers are kept at least 6 years after the date of company dissolution.

Shall the company close its company bank accounts during the deregistration application?

The company shall only close its company bank account when:

- All outstanding money that the company owes to anyone has been settled or cleared. The bank account should not be emptied or closed until all company debts have been cleared, which include salaries or loans to company directors or shareholders; and

- A corporate tax, if any, should also be paid out from this company bank account. Please note that all cash or cash equivalents items will be transferred to the HKSAR government treasury upon successfully deregistration in Hong Kong.

Does the company still need to pay the business registration fees and levies after submission of Deregistration?

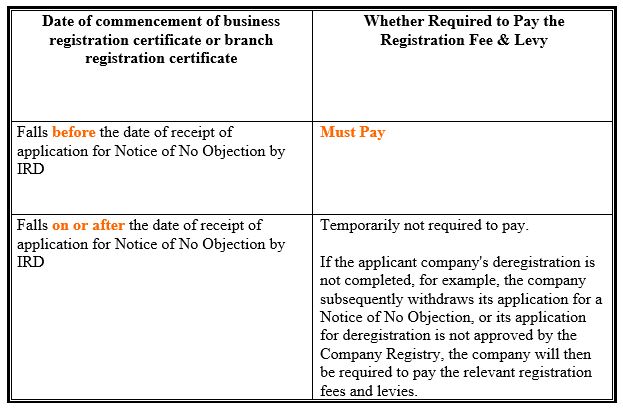

If the applicant company is incorporated under the Companies Ordinance, it is required to renew its business registration certificate fee or branch registration fee until Company Registry approve the deregistration. However, Inland Revenue Department will consider holding the payment request in respect of the certificate anniversary date and the deregistration submission date. The following table is Inland Revenue Department detailed arrangement for Deregistration in Hong Kong.

Deregistration in Hong Kong requires careful handling to ensure full compliance and avoid future liabilities, but doing it yourself can easily lead to delays, missed deadlines, or unknown compliance risks. If you want complete peace of mind throughout the 6‑month process, Get Started HK is here to guide you every step of the way. Reach out to us for professional support and a 100% compliant company closure at info@getstarted.hk. We can provide you with more details and guidance on proper deregistration.

Start Your Hong Kong Company

- 0% Corporate Tax for Offshore Profit.

- 0% Value Added Tax (VAT).

- 0% Capital Gain Tax.

Guaranteed Bank Account Opening

- 100% Successful Rate For Company Registration.

- We offer real solutions to open bank account in Hong Kong.

Company Secretarial Service

Our comprehensive support which allows your company to operate efficiently without physical presence in Hong Kong.

Registered Business Address

Our company formation packages include a registered address service prepared for you hassle-free.