Contents

Last Updated 30 January 2026 When setting up a company in Hong Kong, any person who applies for incorporation of a local company or registration of a non-Hong Kong company under the Companies Ordinance will be deemed to have made a simultaneous application for business registration. Upon approval of the application, the Companies Registry will issue the Certificate of Incorporation and the Business Registration Certificate in one go.

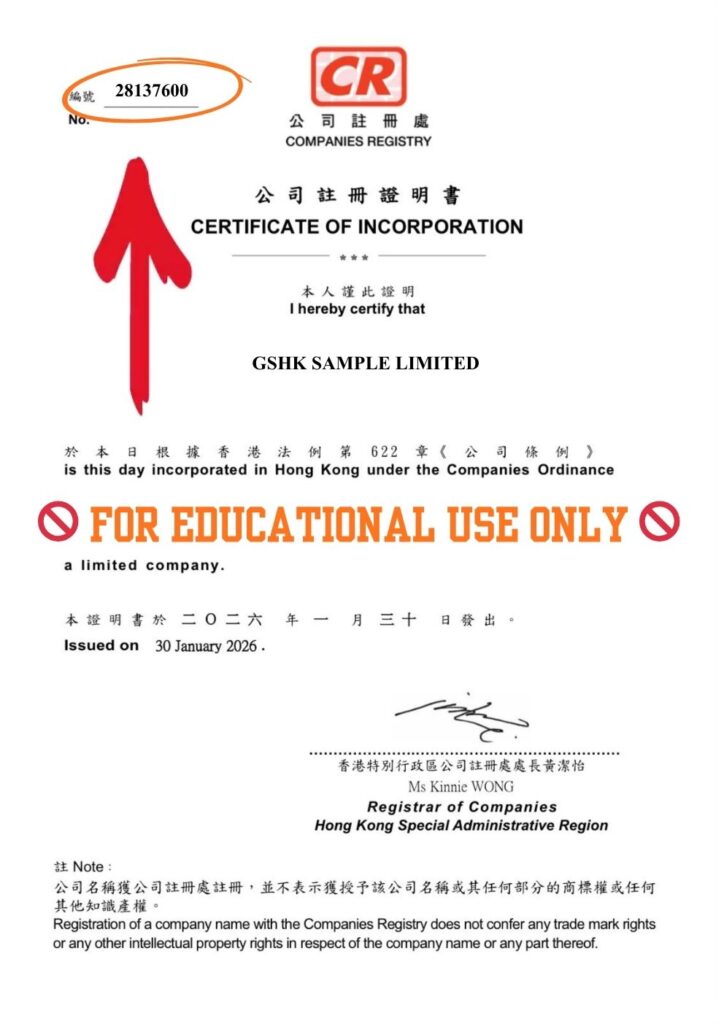

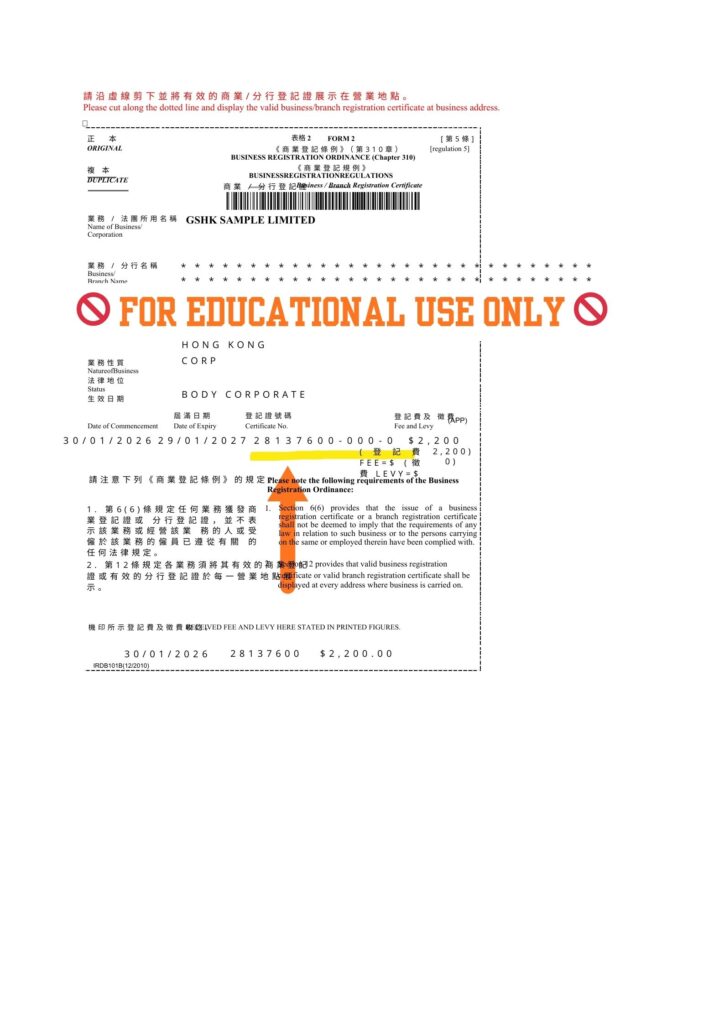

You’ll receive two essential documents: the Certificate of Incorporation, which features your Company Registration Number (CR), and the Business Registration Certificate, which contains your Business Registration Number (BR). Over the years, we come across the same questions from different business owners, “What is my tax number?” “What is BR number?” “What is the CR number?” It seems that there are many confusions caused about these ID numbers.

Locating these identifiers is easy! You can access them through the Hong Kong Companies Registry or the Inland Revenue Department‘s websites. In 2023, the introduction of the Unique Business Identifier (UBI) enhanced the relationship between the BR number and various regulatory systems. This significant change simplifies the identification process for businesses, streamlining compliance and making it easier for entrepreneurs to navigate Hong Kong’s corporate landscape. By understanding the connection between CRN, BRN, and UBI, you can more effectively manage your business’s regulatory requirements.Where to Locate a CRN or BRN?

- Certificate of Incorporation: For new companies, the number labeled as “No.” is actually your Business Registration Number (BRN).

- Business Registration Certificate (BRC): This document includes your BRN, which is derived from the first eight digits of the certificate number.

Below, you’ll find a sample of a Certificate of Incorporation from a Hong Kong company, showcasing the CR Number, and a Business Registration license displaying the BRN for reference.

Figure A. Certificate of Incorporation

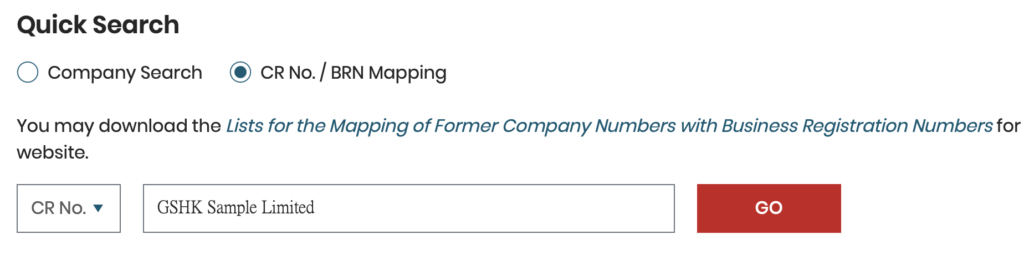

By logging in to Companies Registry e-Services Portal, you can find your company registration number by entering your full company name and clicking “search” (see Figure B). Your CR number will then be on the left-hand side of your company name.

Figure B. Entering full company name at e-Services Portal

To locate your Business Registration Number (BRN), head over to the Business Registration Number Enquiry section on the Inland Revenue Department’s website.Why Unique Business Identifiers (UBI)?

Let’s delve into the Unique Business Identifier (UBI) and how it’s revolutionizing the way we identify businesses in Hong Kong. By adopting the Business Registration Number across Companies Registry records and searches, the UBI enhances consistency between the Companies Registry and the Inland Revenue Department systems. This means a smoother and more streamlined identification process for everyone involved.Is the UBI the Same as the CRN?

Absolutely! The UBI has officially replaced the Company Registration Number (CRN) for businesses registered with the Companies Registry after Dec 2023. If you come across old documents, you’ll still see the historical CRNs, which can be easily linked to their respective BRNs. Now, you might be wondering where you’ll actually use the UBI. It’s quite versatile! The UBI, which is identical to the BRN, will be your go-to identifier when interacting with government offices and other businesses. Companies will need to use the UBI when filling out forms and submitting documents to the Companies Registry. Additionally, if you want to search for companies, you can conveniently use the UBI through the eServices Portal of the Companies Registry.New UBI Guidelines for Businesses Since December 2023

For any business established or registered on or after December 27 2023, you’ll find the UBI displayed as the company “No.” on official certificates, such as the Certificate of Incorporation. This transition not only simplifies identification but also fosters greater clarity in business operations, making it easier for both companies and regulatory bodies to stay connected. If you have any further questions about the CRN, BRN or UBI, feel free to ask our corporate secretaries!When do you need to use these numbers?

You will need to provide these numbers on lots of occasions, such as:

- appointing or removing a company director

- changing passport or residential address details of a company director

- allotting new company shares / increasing share capital

- filing annual return NAR1

- issuing share certificates

- Issuing dividends vouchers

- Preparing company resolutions

- dissolving a company

Behind the Scenes: GetStarted Fun Fact Reveal!

At our firm, our Compliance team has been actively conducting company health checks for our clients. We make it a priority to ensure that all filings are up to date and that nothing is outstanding. Over the past two years, we’ve gathered some valuable insights. Interestingly, we’ve noticed that government officers rarely use the term UBI at the Companies Registry or the Inland Revenue Department. Instead, they simply ask, “What’s the BRN?” This brings us back to a crucial point: if you’ve been following our blog, you’ll recognize that CRN = BRN = UBI. They’re essentially the same thing! By staying aligned with this understanding, you can navigate your compliance needs more effectively.What is your TIN number?

Hong Kong does not issue TIN for taxpayers. The most relevant identification that equivalent to TIN is the Business Registration Certificate number. The BR number follows an unique 8-digit sequence (i.e. 28137600- ### – ## – #- #) at the middle of the Business Registration license and under the subheading “Certificate No” (see Figure C). Each business must secure one for business operation and IRD tax payment in Hong Kong.

Figure C. Business Registration Certificate

If you do not have your BR certificate on hand, there is also a quick way to check your BR number online. You can conduct a search at GovHK Business Registration Number Enquiry ( www.gov.hk/br ). There is no government charge for the search.

The business registration license must be renewed every year, unless you have chosen to pay for 3 years instead of 1. The license must be displayed in a conspicuous area at the address where the business activity is carried on and should be produced for official inspection on demand. An authorized inspector who sends by Inland Revenue Department has power to enter your office or store to make examination and inquiry as may be necessary.

If you happen to lose your business license by accident, you can obtain a new duplicate valid business license from the Business Registration Office with payment of the prescribed fee. You can also make an online application via the website of GovHK : www.gov.hk/br (Online Application for Business Registration Documents).

Get Your UBI = CRN = BRN Checked Effortlessly—Let GetStarted Handle It for You! Contact Us at info@getstarted.hk!