Business registration and company registration in Hong Kong serve different purposes. They are regulated by different laws and different registration systems administered by separate government departments. Over years, I often come across the same questions from different business owners, “What is my tax number?” ”What is BR number?” “What is the CR number?” It seems that there are many confusions caused about these ID numbers. Today, I would like to clarify and explain further with you.

When registering a business in Hong Kong, HKSAR government provides an one-stop joint service by the Companies Registry and the Inland Revenue Department. Any person who applies for incorporation of a local company or registration of a non-Hong Kong company under the Companies Ordinance will be deemed to have made a simultaneous application for business registration. Upon approval of the application, the Companies Registry will issue the Certificate of Incorporation and the Business Registration Certificate in one go.

Hence, there are two important Company Numbers as identity numbers (ID) for Hong Kong Companies. They are the Company Registration number and Business Registration number. You don’t apply for them. You get them automatically at the time you register the company.

What is the Company Registration (CR) Number?

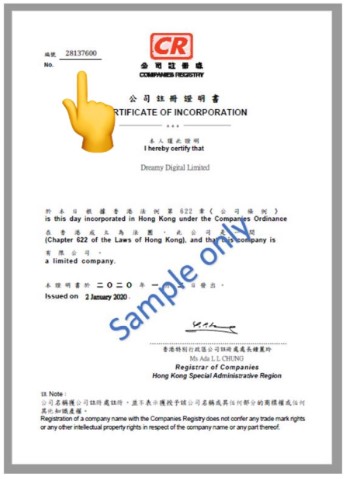

A company registration number is a unique combination of numbers. It is used to identify your company and verify the fact that it is an entity registered with Hong Kong Companies Registry. As mentioned, the company registration number is automatically assigned by Companies Registry once a company is formed. You cannot select or reserve a particular number. At the same time, you can never change it. Even if your company has changed the company name, nature of business or share structure, your company registration number will always remain the same. This is the special ID that uniquely defines the company.

This CR number can be found on the top left corner of the Certificate of Incorporation (see Figure A) and top right corner of Articles of Association.

Certificate of Incorporation

Figure A. Certificate of Incorporation

By logging in to Companies Registry Cyber Search Centre, you can find your company registration number by entering your full company name and clicking “search” (see Figure B). Your CR number will then be on the left-hand side of your company name.

Figure B. Entering full company name at Cyber Search Centre

When do I need to use the company registration number?

You will need to provide your company registration number on lots of occasions, such as:

- appointing or removing a company director

- changing passport or residential address details of a company director

- allotting new company shares / increasing share capital

- filing annual return NAR1

- issuing share certificates

- Issuing dividends vouchers

- Preparing company resolutions

- dissolving a company

What is the Business Registration (BR) Number?

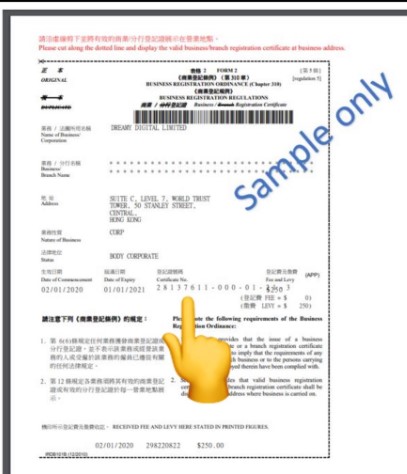

Hong Kong does not issue TIN for taxpayers. The most relevant identification that equivalent to TIN is the Business Registration Certificate number. The BR number follows an unique 8-digit sequence (i.e. 70569713– ### – ## – #- #) which is issued and assigned by the Inland Revenue Department (IRD) at the date of incorporation. This number is shown at the middle of the Business Registration license and under the subheading “Certificate No” (see Figure C). Each business must secure one for business operation and IRD tax payment in Hong Kong.

BR sample

Figure C. Business Registration Certificate

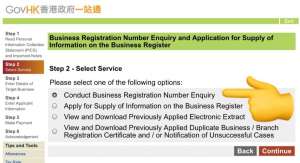

If you do not have your BR certificate on hand, there is also a quick way to check your BR number online. You can conduct a search at GovHK Business Registration Number Enquiry ( www.gov.hk/br ). There is no government charge for the search.

Check the 3 simple steps below.

Step 1: Select “Conduct Business Registration Number Enquiry”.

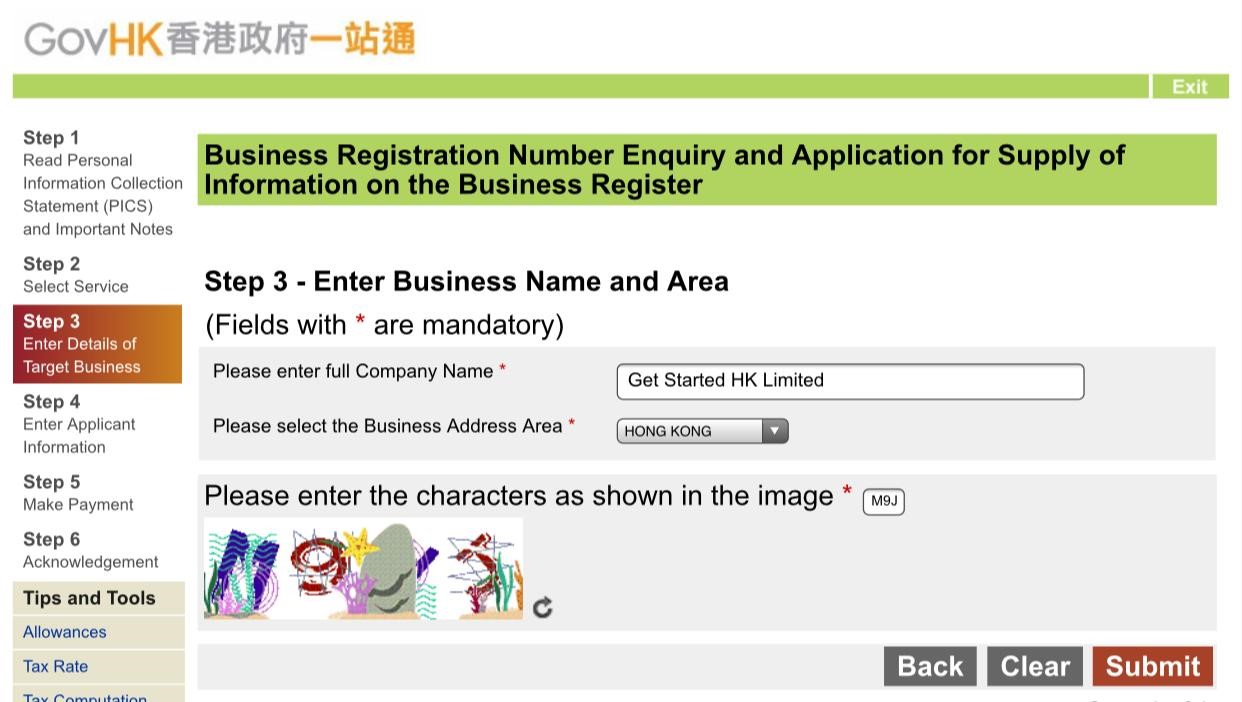

Step 2: Input the full company name and business address area code here (i.e. Hong Kong, Kowloon or New Territories) and press the “Submit” button.

Search BR number

Step 3. Ta-Da! You will then get your Business Registration number.

Result of BR number

The business registration license must be renewed every year, unless you have chosen to pay for 3 years instead of 1. The license must be displayed in a conspicuous area at the address where the business activity is carried on and should be produced for official inspection on demand. An authorized inspector who sends by Inland Revenue Department has power to enter your office or store to make examination and inquiry as may be necessary.

If you happen to lose your business license by accident, you can obtain a new duplicate valid business license from the Business Registration Office with payment of the prescribed fee. You can also make an online application via the website of GovHK : www.gov.hk/br (Online Application for Business Registration Documents)

Interesting fact:

Both company registration number and business registration number are the “brand” that marks your company as distinct, legally. You will need to quote these numbers when interacting with Companies Registry, Inland Revenue Department and setting up a company bank account in Hong Kong.

References

[1] Inland Revenue Department. (2018, February 28). Business Registration. Retrieved from https://www.ird.gov.hk/eng/tax/bre_brd.htm

[2] Inland Revenue Department. (2019, February). Business Registration Number Enquiry. Retrieved from https://www.gov.hk/en/residents/taxes/etax/services/brn_enquiry.htm

[3] Companies Registry. (2020). Companies Registry Cyber Search Centre. Retrieved from https://www.icris.cr.gov.hk/preDown.html