Contents

- Key Takeaways:

- Why does selecting the right code matter for your business?

- Decoding the HSIC code

- SIC Code 28 – Chemicals and Allied Products

- SIC Code 5511- Motor Vehicle Dealers (New and Used)

- SIC Code 8062 – General Medical and Surgical Hospital

- SIC Code 4225 – General Warehousing and Storage

- SIC Code 7999 – Amusement and Recreation Services, Not Elsewhere Classified

- How do you select the right code for your business?

- Frequently Asked Questions about collection of personal data

Key Takeaways:

- The HSIC code is a number used by Hong Kong’s Census and Statistics Department to collect and analyze industry data

- Selecting an HSIC code is a standard requirement for company registration and tax filing

- The HSIC framework is not to be confused with the SIC classification regime, which is an outmoded US classification regime still in use amongst databases overseas

The Hong Kong Standard Industrial Code (HSIC) is a 6-digit number that classifies businesses according to the nature of their economic activities. Hong Kong’s Census and Statistics Department (CSD) uses these industry codes to compile and conduct analyses of industry statistics.

Every Hong Kong company is required to select an HSIC code to complete company registration and tax filing. If the company conducts business in multiple sectors, it may even register for multiple HSIC codes to reflect the diversity of its business operations.

Why does selecting the right code matter for your business?

Compliance

In Hong Kong, government bodies like the Companies Registry (CR), the Customs and Excise Department (C&ED), and the Inland Revenue Department (IRD) use HSIC codes to keep tabs on business activities. Choosing the wrong code can be tantamount to providing false information to government authorities, which can result in government fines.

The IRD, in particular, can request additional audits if your HSIC code doesn’t align with your actual activities, leading to higher time and monetary costs.

License application

Certain types of businesses, such as employment agencies and tourism agencies, require licenses from the relevant government bodies to operate in Hong Kong. Selecting the wrong HSIC code can prevent businesses from securing the necessary licenses to operate in a compliant manner.

Bank application

Hong Kong banks follow rigorous AML and due diligence protocols. Thus, even slight discrepancies in the information you provide can affect your chances of opening a bank account: all the more reason to be careful with how you classify your business.

However, HSIC codes are more than a mandatory requirement to fulfil. Selecting the right code can also unlock significant benefits for your business.

Government grants

The Hong Kong Government provides myriad industry specific grants, including the CreateSmart Initiative, which targets local creative industries, and the SME Export Marketing Fund, which supports HK companies conducting promotional activities targeting overseas markets.

Your HSIC code tells government officials whether your company’s activities qualify for industry specific grants. Selecting the wrong code can thus result in missed opportunities.

Market Research

Industry statistics are freely available on the C&SD’s website, making it a powerful tool for conducting market research. As the data is organised according to HSIC codes, knowing your own code enables you to isolate industry data that’s useful to your business. You may then analyse industry trends, and identify opportunities and obstacles.

Decoding the HSIC code

There are five hierarchies in the HSIC system, and their characteristics are summarised below:

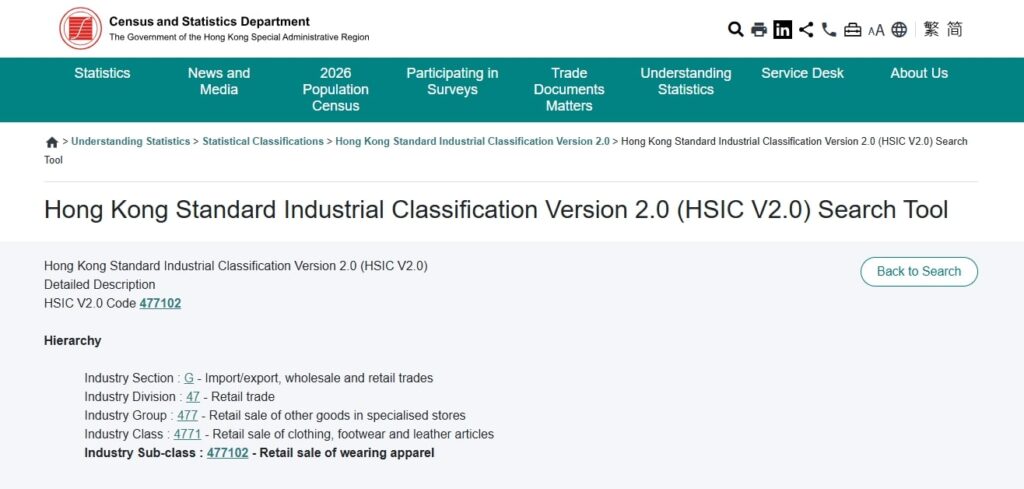

| Level | Number of categories in this level | Denotation | Example |

| 1. Industry Sections | 21 | One of the 21 alphabet letters from A-U | G – Import/export, wholesale and retail trades |

| 2. Industry Division | 88 | A 2-digit numeral running from 01-99 | 47 – Retail trade |

| 3. Industry Group | 221 | A 3-digit numeral ranging from 011 to 990 | 477 – Retail sale of other goods in specialised stores |

| 4. Industry Class | 483 | A four-digit numeral ranging from 0110 to 9900 | 4771 – Retail sale of clothing, footwear and leather articles |

| 5. Industry Sub-class | 1001 | 6-digit code ranging from 011000 to 990000. | 477102 – Retail sale of wearing apparel |

A shop involved in the retail sale of suits, for example, would have 477102 as its HSIC code.

Note: If a company’s activities are broad, it can be classified at higher levels with fewer digits in their HSIC code.

Are HSIC and SIC codes the same?

The HSIC code is often confused with the Standard Industrial Classification (SIC) code. SIC codes are four-digit numerical codes created by the US government to categorize businesses. Though they’ve now been replaced by another classification regime, they are still widely used by many US and European databases. As we’ll see below, there’s no correlation between SIC and HSIC codes.

Consider the following examples:

SIC Code 28 – Chemicals and Allied Products

- The HSIC analogue is 20 – Manufacture of chemicals and chemical products

SIC Code 5511- Motor Vehicle Dealers (New and Used)

- The HSIC analogue is 477301 – Retail sale of motor vehicles

SIC Code 8062 – General Medical and Surgical Hospital

- The HSIC analogue is 861100 – Hospitals

SIC Code 4225 – General Warehousing and Storage

- The HSIC analogue is 521 – Warehousing and Storage

SIC Code 7999 – Amusement and Recreation Services, Not Elsewhere Classified

- This category includes businesses engaged in yoga instruction, the operations of lotteries, and the rental of pleasure boats

- There is no clear HSIC analogue

- The renting of pleasure boats falls under 772100 – Renting and leasing of recreational and sports goods

- Yoga Instruction falls under 854104 – Yoga and gymnastics instruction

- The operation of lotteries falls under 939100 – Betting activities

General points to note

- The names of industry groups in the HSIC and SIC system always differ

- Economic activities broadly included under 1 SIC code can be classed under multiple different HSIC codes

- It is not possible to find equivalents for HSIC codes amongst SIC codes

How do you select the right code for your business?

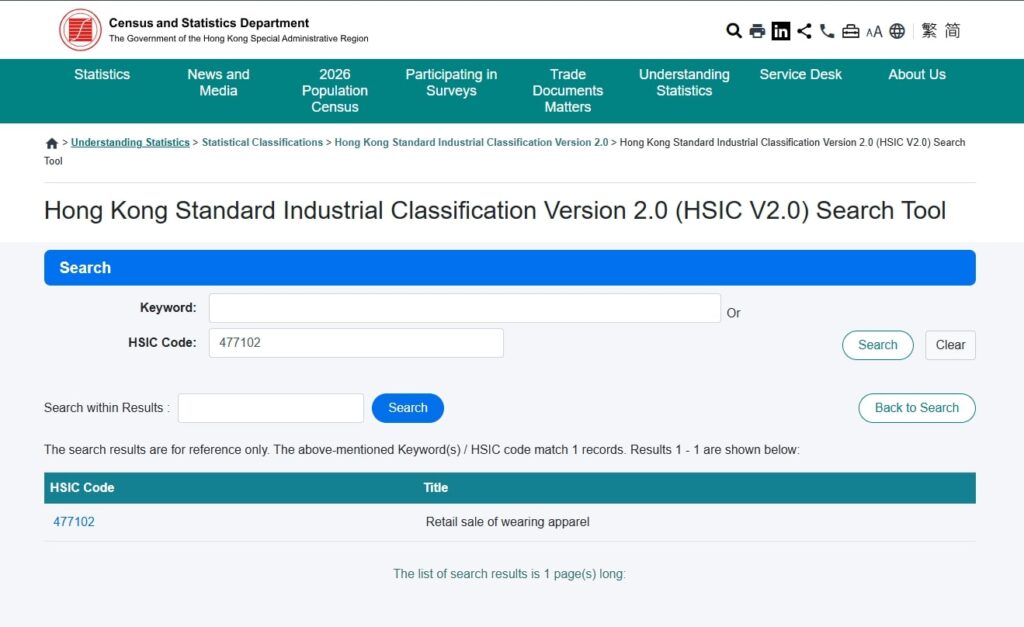

1. Explore the HSIC V2.0 Online Search Tool on the C&SD’s official website.

2. In the search bar, input the keywords related to your business’s activities.

Alternatively, a business may complete the General Enquiry Form of HSIC V2.0 to obtain their own HSIC code. Upon providing the requested details, such as the owner’s personal particulars and details about the company’s main business activities, you may email the document directly to the Census and Statistics Department.

3. After selecting a code, consult the HSIC V2.0 Guide to check for conditions and excluded activities under each code.

Tip: If you plan to expand services or change operations, choose a code that allows flexibility.

Frequently Asked Questions about collection of personal data

1. How many SIC codes can a company have?

Every Hong Kong company is required to select at least one HSIC code to complete company registration and tax filing. However, if the company’s activities stretch across multiple sectors, it may register for multiple HSIC codes to reflect the diversity of its business operations.

2. How do I find a company’s SIC code?

You may find a Hong Kong company’s SIC code by using the HSIC code search tool on the C&SD’s official website. Simply input keywords related to the company’s business activities, and the search tool will generate the relevant HSIC code(s).

3. What are the 4 types of industry?

Under the HSIC classification system, there are 21 types of industries, each assigned a letter from A-U. You may review the full list below.

- Industry Section A – Agriculture, forestry and fishing

- Industry Section B – Mining and quarrying

- Industry Section C – Manufacturing

- Industry Section D – Electricity and gas supply

- Industry Section E – Water supply; sewerage, waste management and remediation activities

- Industry Section F – Construction

- Industry Section G – Import/export, wholesale and retail trades

- Industry Section H – Transportation, storage, postal and courier services

- Industry Section I – Accommodation and food service activities

- Industry Section J – Information and communications

- Industry Section K – Financial and insurance activities

- Industry Section L – Real estate activities

- Industry Section M – Professional, scientific and technical activities

- Industry Section N – Administrative and support service activities

- Industry Section O – Public administration

- Industry Section P – Education

- Industry Section Q – Human health and social work activities

- Industry Section R – Arts, entertainment and recreation

- Industry Section S – Other service activities

- Industry Section T – Work activities within domestic households

- Industry Section U – Activities of extraterritorial organisations and bodies

4. What are sic and naics codes and how are they used?

HSIC, SIC and North American Industrial Classification System (NAICS) codes are each part of different classification regimes designed to categorise business according to their principal business activities. Where the HSIC is a system specifically designed for Hong Kong’s economic situation by the Hong Kong government, SIC and NAIC codes are developed by the US government. In 1997, the US government adopted NAICS as its new industrial classification system, replacing the relatively more simplistic SIC. Nonetheless, SIC codes continue to be used in American and European commercial databases.