Key Takeaways

- Appointment of director is a process strictly governed by a company’s Articles of Association

- Besides directors’ approval, an ordinary or special resolution may be required for appointment of director

- An ordinary or board resolution for appointment of director should be signed and kept on file after it has been passed

- Appointment of director form (ND2A) should be filed at the Companies Registry within 15 days of passing the resolution

- Director changes should be brought to bank’s attention to prevent account freezes

As a business matures, branching out in different directions may be the best way to ensure that it will continue to flourish. Adding a new director to the company is a good way to inject new ideas into your business, and below, we will outline the steps you and your corporate service provider will take to institute this change in a compliant manner.

What are your responsibilities before appointment of director?

The first step is to first consult your company’s Articles of Association (AoA). Being your company’s legally binding “rulebook,” the AoA specifies requirements for director qualifications, the maximum number of directors your company can have, appointment procedures, and appointment terms.

For instance, the Model Articles state that a director appointed by the company’s shareholders may hold office for an unlimited period of time, whereas a director appointed by other directors must retire from office at the next annual general meeting after the appointment.

As breaching the AoA can nullify your actions, you should carefully read your AoA before proceeding with the director change.

Appointment of director: Ordinary or Special resolution?

Model articles provided by the HK government stipulate that directors may either be appointed via an ordinary resolution (which is passed with the approval of over 50% of the company’s shareholders), or via a decision of the directors (i.e. when a majority of directors on the board agree to the decision).

That said, if a company wishes to raise the bar for appointing a new director, it may certainly alter its Articles of Association to state that the appointment of a new director can only be effected by a special resolution, whose passing requires 75% of shareholder votes.

Who can be appointed?

Much like your company’s AoA, the Companies Ordinance (Cap. 622) also states requirements for companies and individuals taking up directorship:

- A corporation may be appointed as a director of a HK private limited company, but the company must also have at least 1 natural person director

- Natural person directors must be at least 18 years old

Note, however, that unlike in many other jurisdictions, there is no law in Hong Kong restricting the nationalities of directors, and no regulation that requires companies to appoint a local director. In other words, it is perfectly viable for a Hong Kong company to be directed (and owned) completely by foreigners.

Step 1 – Board resolution for appointment of director

Depending on what the company’s AoA specifies, the board of directors or the company’s members must pass a resolution to authorize the appointment of the new director. This is usually either a board resolution or an ordinary resolution.

The appointment comes into effect the moment the resolution is passed.

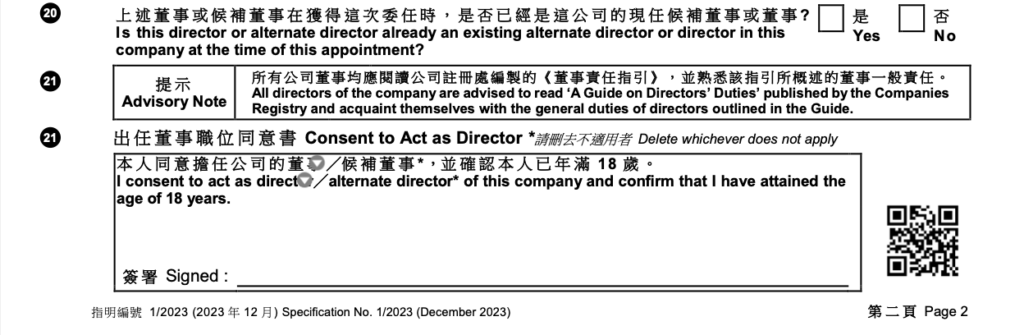

Step 2: Filling in Appointment of Director Form ND2A

Within 15 days of the effective date of the director change, the company must file the Form ND2A Notice of Change of Company Secretary and Director (Appointment/ Cessation) at the Companies Registry. This form contains the details of the old and new directors, such as their passport numbers and correspondence address, and a declaration of acceptance where the new director confirms that they agree to take up the office and are above 18 years old.

If signed on the effective date, the form may be signed by either the resigning or the new director. However, if it’s signed after the effective date, only the new director may sign.

Step 3. Filing Form ND2A

The form may be filed online, via the government’s e-services portal, or it may be delivered by post or in person to the Companies Registry’s office. The filing, like most other government filings, is typically handled by your Company Secretary, who will ensure that the filing is completed accurately and on time.

The Companies Registry will then take around 2 business days to process the change.

After filing the change of director form, notify your bank

It isn’t a legal requirement to inform your bank after directorship changes. However, banks in Hong Kong routinely check on companies every few years. During checking, both members and directors will be asked to provide their personal information.

If your bank finds out about directorship changes before you inform them, this can erode the bank’s trust in you and even lead to an account freeze. Therefore, inform your bank as soon as the government filings have been completed, and tell your newly appointed director to expect a physical bank interview soon.

There is no reason that your company’s transition into new leadership should be a jarring one. If you want your company’s director change to be handled quickly and by the book, leave it to a trustable corporate service provider. Let us know how we may help.

Frequently Asked Questions

1. What is required to appoint a director?

Depending on what the company’s Articles of Association specify, majority director approval in the form of a board resolution, or majority shareholder approval in the form of an ordinary resolution, is required for directorship changes. A company may also specify in its Articles that a special resolution, which can only be passed with at least 75% shareholder votes, is required to appoint a new director. Once the change has been approved, the resolution should be signed and kept on file, and the relevant government form should be filed within 15 days after passing the resolution.

2. What form is required for director appointment?

To notify the government of the appointment of a new director, Form ND2A Notice of Change of Company Secretary and Director (Appointment/ Cessation) must be filed at the Companies Registry. This form contains fields where you will provide the personal particulars of both the old and the new directors, and a signature field for the new director to confirm that they agree to take up the appointment and are above 18 years of age.

3. How quickly can you appoint a director?

The appointment of a new director will be effective immediately after the relevant resolution has been passed. In this sense, a director may be appointed in less than one day. The company would then be required to file Form ND2A within 15 days of the effective date to inform the Companies Registry of the appointment, and the government body would take around 2 business days to process the change. However, the effective date is the day on which the resolution is passed, and not the filing date. If you’d require assistance in preparing the government form, feel free to contact Get Started HK.

4. What is the time limit for appointment of director?

After the effective date of the new director’s appointment, the company is required to file Form ND2A Notice of Change of Company Secretary and Director (Appointment/ Cessation) within 15 calendar days. The maximum penalty for late filing is HK$25,000, together with a daily default fine of HK$700. To avoid late filing, select a trusted corporate service provider and ensure sound communication.

5. Does appointing a new director require shareholder approval?

The answer ultimately depends on the company’s Articles of Association, which may be altered to fit the needs of the company. In the Model Articles, which most HK companies adopt, both the board of directors and shareholders have the power to appoint a director. However, directors are only given power to appoint new directors in specific circumstances, such as to fill a casual vacancy.

6. Can a 51% shareholder remove a director?

Yes, a 51% shareholder generally can remove a director. An HK company’s Articles of Association commonly authorises the removal of a director by means of passing an ordinary resolution, which only requires a simple majority of shareholder votes. That said, a company may certainly alter its Articles of Association and change the kind of approval that is required to appoint a new director. If you’d like to learn more about the implications of altering your company’s Articles, feel free to reach out to Get Started HK’s consultants.

7. Can I be a director without shares?

Yes, a director may take up office without being a shareholder at the same time. There is no law in Hong Kong stipulating that directors must also hold shares in the companies they direct, nor a law stipulating that a director may not also act as a shareholder at the same time. In this way, Hong Kong company law imposes fairly few restrictions on company structure.

8. How are first directors appointed?

First directors are appointed at the moment of incorporation. The documents that can act as proof of their appointment include the First Written Resolution and the NNC1 form, which states the identity of the company’s company secretary and the first director(s). The NNC1 form, in particular, contains a field where the first director(s) may sign to signify their agreement to take up the office of director and are above 18 years old.

Start Your Hong Kong Company

- 0% Corporate Tax for Offshore Profit.

- 0% Value Added Tax (VAT).

- 0% Capital Gain Tax.

Guaranteed Bank Account Opening

- 100% Successful Rate For Company Registration.

- We offer real solutions to open bank account in Hong Kong.

Company Secretarial Service

Our comprehensive support which allows your company to operate efficiently without physical presence in Hong Kong.

Registered Business Address

Our company formation packages include a registered address service prepared for you hassle-free.