Corporate Tax Rate for the year 2020/21 & How does the budget report help companies in Hong Kong?

Hong Kong Financial Secretary, Paul Chan, issued the 2020/21 Budget report earlier this year. The report illustrates the corporate tax rate for the year 2020/21. The report shows that Hong Kong has a solid financial reserve and the Government is ready and prepared to help business and boost the economy. A budget of 18.3 billion will be used to support companies in Hong Kong. Below is a summary.

Support Enterprises and Safeguard Jobs

- Introduce a concessionary low interest loan, with a ceiling of 2 million HK dollar. The Government provides guarantee of up to 20 billion HK dollar under this loan scheme.

- Waive 100% profits tax for the year 2019/2020, subject to a ceiling of HK$20,000.

- Waive rates for non-domestic properties for the first two quarters, with a ceiling of HK$5,000.

- Waive rates for non-domestic properties for the third and forth quarters, subject to a ceiling of HK$1,500.

- Reduce business registration license fee from HK$2,250 to HK$250 for 2020/2021.

- Waive Companies registry’s registration fees for annual return form except for late delivery

- Subsidize 75% of electricity bills for non-domestic household accounts for additional 4 months, subject to a ceiling of HK$5,000 per month.

- Subsidize 75% of water and sewage bills by non-domestic households for additional 4 months, subject to a ceiling of HK$20,000 and HK$12,500 per month.

- Provide local recycling business 6-month rental subsidy.

- Provide 6-month rental subsidy for tenants of government properties.

- Provide tenants of Cruise terminal a rent reduction for 6-month.

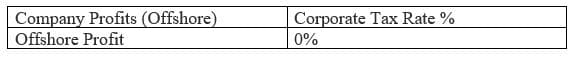

What is the corporate tax rate for Offshore company in Hong Kong?

Hong Kong adopts “Territorial Source Principle“. Offshore profit is not taxable by the Hong Kong authority. If you want to know more about how to obtain offshore status in Hong Kong, you can refer to our previous article. Alternatively, you can contact one of our Hong Kong company formation specialist at info@getsatrted.hk

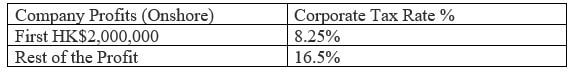

What is the corporate tax rate for Onshore company in Hong Kong?

Corporate Tax rate for the first HK$2 million of profits is reduced to 8.25%. Corporate Tax rate on remaining profits is at 16.5%. Losses can continue to be carried forward for each accounting year. Moreover, Hong Kong has no capital gain tax and no withholding tax on payment. There is also no tax on dividend.

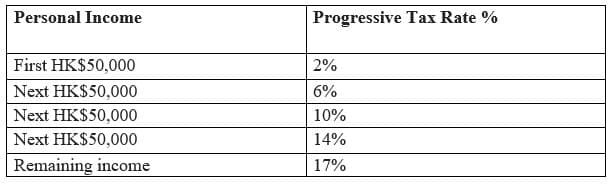

What is the Salary (Personal) Tax rate in Hong Kong?

The progressive tax rate for salary income remains as below for the financial year 2020/21.

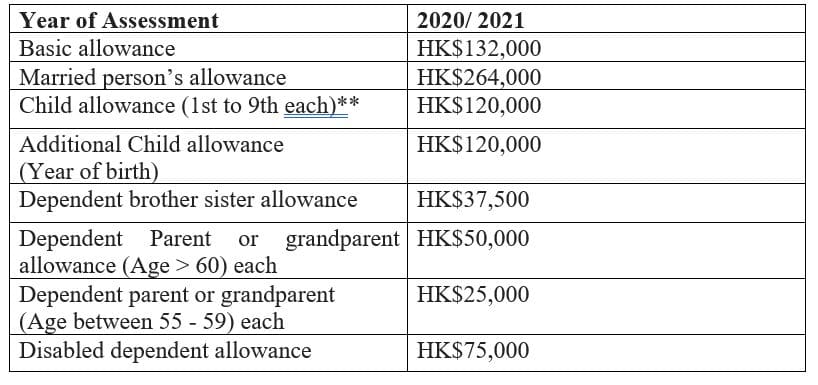

You are entitled to a basic allowance in every assessment. Other allowances are also available, and you can see summary below. As a reminder, you should claim all allowance on your Salary Tax Return Form (BIR60) in the relevant years. Late claims are possible, but you should do it in writing within 6 years after the end of the assessment year.

When you submit the salary tax form, there is no need to submit evidence for the allowance claim at the same time. You only have to provide evidence if the Inland Revenue department asks for verification.

** A child can be your own child, adopted child or step child. In general, there are three scenario you can claim for child allowance. You can claim child allowance if your child is unmarried and is under the age of 18. If your child is over 18 but below the age of 25, and he is under full time education at a University, you can also claim child allowance. If your child is over the age of 18, but he or she is unable to work due to physical or mental disability, you can also claim child allowance.

Avoidance of Double Taxation

Double taxation happens when two or more authorities want to tax the same item of profit. While Hong Kong adopts a territorial source principle. Only profits derived in HK is taxable by the Hong Kong authority. Offshore profit is not taxable. Therefore, Hong Kong companies rarely have concerns with “double taxation”.

Nevertheless, the Hong Kong government has taken initiatives to build a double taxation avoidance network. This can minimize conflicts or problems for corporations and business owners. For example, business like aircraft operations, airline operators, are more likely to have business operations in different countries. A flight from the Malaysia to Hong Kong involves two countries. This is the situation which double taxation treaty can help solve the problem. For easy reference, Hong Kong has signed treaty with 43 countries. Please see table below.

Hong Kong adopts a simple, no or low tax rate system. The government provides one of the best business environments for Hong Kong company. Hong Kong remains in the top 3 at the latest Global Financial Center Index. The city is only behind New York and London. According to the 2019 Index of Economic Freedom, Hong Kong has ranked No. 1 as the world’s freest economy, and we have achieved this top ranking for 25 years consecutively.

Hong Kong adopts a simple, no or low tax rate system. The government provides one of the best business environments for Hong Kong company. Hong Kong remains in the top 3 at the latest Global Financial Center Index. The city is only behind New York and London. According to the 2019 Index of Economic Freedom, Hong Kong has ranked No. 1 as the world’s freest economy, and we have achieved this top ranking for 25 years consecutively.

Get Started HK Limited is experienced in company formation, taxation, accounting, trademark registration and other areas. Should you be interested to start your company in Hong Kong, feel free to contact us for more details.

Disclaimer: This article is intended for reference only. This article is not a piece of taxation advice. The Inland Revenue Department has sole and full discretion in all taxation matters in Hong Kong, including but not limited to granting offshore status. For in-depth information, offshore company owners can purchase a hard copy of Chapter 112 Inland Revenue Ordinance from the Online Government Bookstore. Alternatively, you can contact us for consultation. Thank you for your kind attention.