A company shall prepare its annual return form NAR1 to the Hong Kong Company Registry every year. The filing due date is within 42 days after the anniversary date of company incorporation. Business owners shall note that no time extension will be given for filing and it is an offence for not delivering the return on time.

What is an Annual Return (form NAR1)?

Form NAR1 contains all particulars of the company including the details of registered office address, shareholders, directors, shares structure and company secretary. Such form has to be signed by the director, company secretary, managers or authorized representative.

Deadline for Annual Return to the Registrar of Companies for registration

When a company submits its form NAR1, a prescribed government registration fee of HK$105 must also be included on the delivery of the annual return. The filing due date is within 42 days after anniversary date of company incorporation. Sundays and public holidays are also calculated in this 42 days period. Nevertheless, if the 42nd day falls on a Sunday or public holiday, the Hong Kong Company Registry will extend the due date to the following working day which is neither a Sunday nor a public holiday.

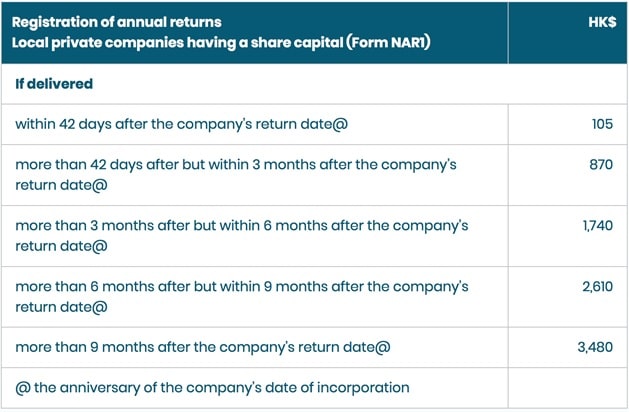

Business owners shall note that no time extension will be given for filing and it is an offence for not delivering the return on time. When the document is delivered late, Registrar will impose different layer of late fee that is up to HK$3480. The Company Registry makes no discretion on the amount of annual registration fees payable.

Registration fee

The registration fee is only HK$105 when the form NAR1 is delivered on time. If the document is a late filing, the registration fee will be up to HK$3480 (refer to Figure A). Company owners who have particular concerns or those who want to save cost and comply with company regulations, you can enroll in our Annual Return e-Reminder Service. This service is included in our deluxe and premium offshore company formation package. We can prepare the form NAR1 for free. So our existing clients need not worry about missing the deadline. You can subscribe for our e-reminder service by contacting our maintenance team at info@getstarted.hk. The service is free of charge and subscribers shall receive an email notification on the anniversary date of incorporation.

Table A. Registration Fee

Table A. Registration Fee

The important tips when Company decides to prepare the document themselves

While our company maintenance team can prepare and submit documents to the Companies Registry on your behalf, some business owners may choose to deliver documents themselves. Below are twelve important tips we’d remind you during your own filing:

- Pay sufficient postage fee if filing is done by post.

- Insufficient postage fee will render the document “unsatisfactory”.

- Government fee varies for different type of document filing. You shall pay the correct fee by cheque.

- Incorrect fee will render the document “unsatisfactory”.

- Unsatisfactory document will not be processed. Daily fine may incur for late filing.

- You must submit the original signed documents (wet signatures).

- E-signatures and duplicate copies are not accepted.

- Remove any pencil remarks before submission.

- Prepare specified forms in full. Do not remove unused pages.

- Do not alter position of any boxes in specified forms. Forms can be rejected.

- Use white colour A4 paper for the cover page. Filing stamp is only visible on white paper.

- Presenter’s details shall be listed at the bottom left corner on first page for easy communication.

Companies and their administrators are responsible to comply with their obligations to deliver this important form NAR1 to Company Registry under the Companies Ordinance for registration. We highly recommend companies to plan ahead and make their own arrangements (e.g. subscribe our e-Reminder service) to deliver the document on time.