Contents

- Step 1: Download the NNC1 Form

- Step 2: Fill-Out the NNC1 Form.

- 2.1 Fill in the proposed company name.

- 2.2 Type of Company.

- 2.3 Fill in the proposed Registered Office address in Hong Kong.

- 2.4 Fill in the Presentor’s Reference section.

- 2.5 Fill in the Share Capital and Initial Shareholdings on the Company’s Formation section.

- 2.6 Fill in the Founder members and Directors information section

- 2.7 Fill in the Company Secretary information.

- 2.8 Fill in the Director (Natural Person)

- 2.9 Fill in the Body Corporate

- 2.10 Don’t forget to tick the appropriate boxes

- Conclusion

The article below was written in 2020. While the core information is still accurate, Hong Kong’s company formation landscape has changed significantly since then, and most submissions are now handled through e-filing in the year 2026. That said, if you are interested in the history of Hong Kong’s filing procedures, or if you have a specific need to submit documents in paper format, this artilce is still a useful reference.

In one of our previous blogs – Hong Kong Company Formation guide for foreigners, we mentioned two (2) ways to set up a Hong Kong Company: paper application and online application. In this article, we will talk about how to prepare the paper application – NNC1 form.

Many startups choose to hire a professional agent to assist them in their company formation. This is because if you decide to do it yourself instead of hiring a Hong Kong company agent, you may need to use a combination of both the paper and online applications. It can be a hassle, but it’s still doable. However, if you aren’t the type to shy away from a challenge, then you can follow along with our DIY guide in preparing the NNC1 form to register your own Hong Kong Company. Here are some tips for preparing the first step of incorporating your private limited company in Hong Kong — filling out the NNC1 Incorporation Form.

Step 1: Download the NNC1 Form

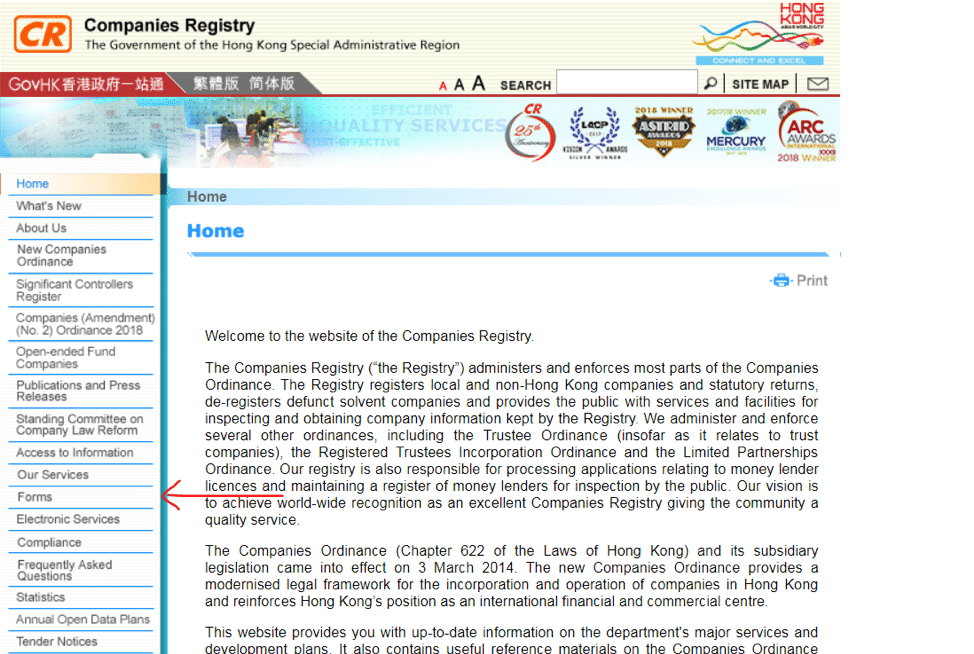

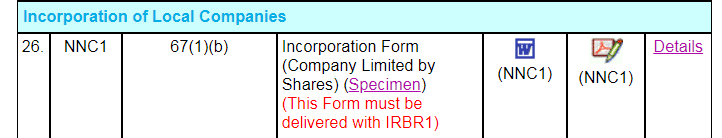

Visit the Companies Registry official website and select your preferred language. On the left-hand menu bar, mouse over ‘Forms’, and click ‘Specified Forms.’ There are two types of companies in Hong Kong. If your company is a non-profit, you should download the NNC1G form. If your company is a for-profit, you should download the NNC1 form. Now, let’s assume that your company is for-profit since you are starting a business in Hong Kong. Download the NNC1 form. We recommend that you download the .pdf version because it is easier to fill-out.

Visit the Companies Registry official website and select your preferred language. On the left-hand menu bar, mouse over ‘Forms’, and click ‘Specified Forms.’ There are two types of companies in Hong Kong. If your company is a non-profit, you should download the NNC1G form. If your company is a for-profit, you should download the NNC1 form. Now, let’s assume that your company is for-profit since you are starting a business in Hong Kong. Download the NNC1 form. We recommend that you download the .pdf version because it is easier to fill-out.

Step 2: Fill-Out the NNC1 Form.

In this example, we’ll demonstrate how to fill out the NNC1 form, which is for private limited companies. The form is in both Chinese and English. Hence, foreigners can also understand the incorporation form easily. The form may look simple, but a tiny mistake can cause HUGE delay. In worst case scenario, the company registry may even reject the application.

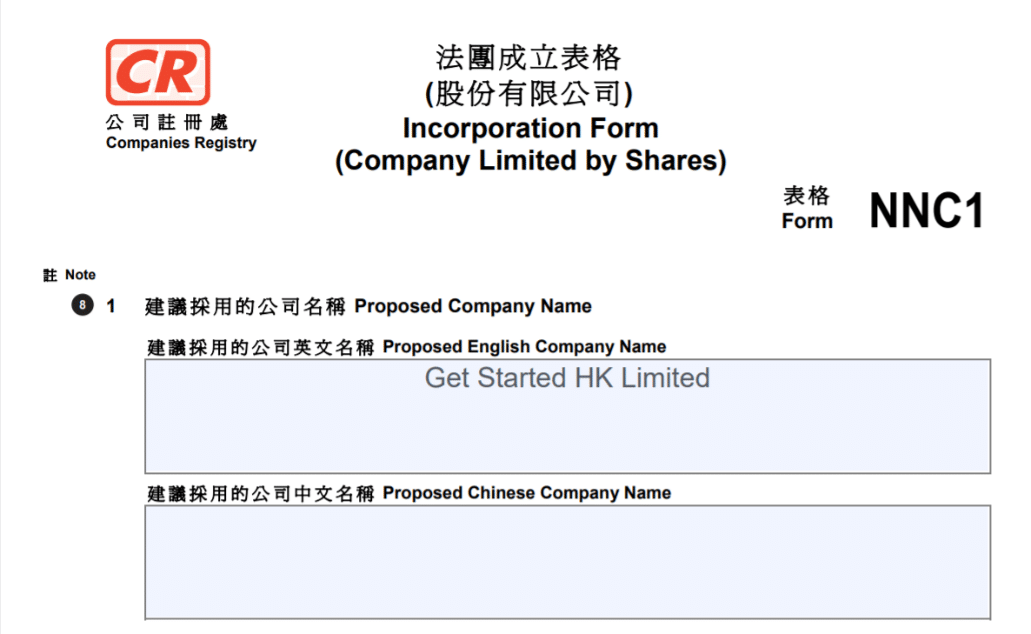

2.1 Fill in the proposed company name.

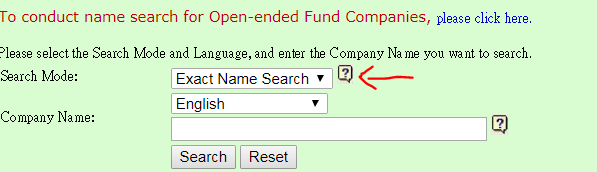

Make sure you search the Companies Registry’s Cyber Search Centre to see whether your proposed company name is available. When you search, make sure to set the Search Mode to “Exact Name Search”. Avoid using “Left Partial Search” because it will give you inaccurate results. If you need more guidance in choosing a company name, please refer to our Hong Kong Company Establishment FAQ of our website, or my previous article.

2.2 Type of Company.

Private must be checked.2.3 Fill in the proposed Registered Office address in Hong Kong.

Your company must have a registered office address in Hong Kong. It must be a commercial address and not a residential address. The Hong Kong SAR government usually sends four letters to a Hong Kong limited company per year: one (1) from the Statistics Department and three (3) from the Inland Revenue Department. All these letters have a timeframe to reply, and a late fee will incur if one does not respond before the deadline. Hence, it is important to choose a reliable TCSP licensee for the business office address service.

Get Started HK can offer you a virtual address service at World Trust Tower in Central. Central is known to be the Central business district (CBD) in Hong Kong and it is often viewed as the most premier business location. If you want to present the best image to your customers, you should choose our registered address in Central when completing your business registration process in Hong Kong.

We do not merely provide an address parking service. If your company receives any government mail, our team will open and scan them free of charge. We provide appropriate guidelines so you can understand the action(s) needed to be taken. As a hassle-free service, you can also expect prompt and reliable updates so you can focus on developing your business.

Your company must have a registered office address in Hong Kong. It must be a commercial address and not a residential address. The Hong Kong SAR government usually sends four letters to a Hong Kong limited company per year: one (1) from the Statistics Department and three (3) from the Inland Revenue Department. All these letters have a timeframe to reply, and a late fee will incur if one does not respond before the deadline. Hence, it is important to choose a reliable TCSP licensee for the business office address service.

Get Started HK can offer you a virtual address service at World Trust Tower in Central. Central is known to be the Central business district (CBD) in Hong Kong and it is often viewed as the most premier business location. If you want to present the best image to your customers, you should choose our registered address in Central when completing your business registration process in Hong Kong.

We do not merely provide an address parking service. If your company receives any government mail, our team will open and scan them free of charge. We provide appropriate guidelines so you can understand the action(s) needed to be taken. As a hassle-free service, you can also expect prompt and reliable updates so you can focus on developing your business.

2.4 Fill in the Presentor’s Reference section.

What is a Presentor?

Over the years, many foreigners have made a common mistake of using their own name when filling out the presentor’s reference section. A Presentor is a person who can collect the certificate of incorporation and business license. You must specify a person or a company to receive the documents on your behalf. If you appoint ‘Person A,’ then only ‘Person A’ can collect the documents. So even if ‘Person B’ is the director of the company, the Companies Registry will not release the certificate.

If you still decide to fill in your name in this block, then you need to be in Hong Kong to collect the certificate yourself. The Companies Registry does not arrange mailing of the certificate of incorporation and business registration license. The presentor must collect the certificate and business license in person. If you cannot be in Hong Kong in person, you can authorise Get Started HK to collect the certificates on your behalf.

2.5 Fill in the Share Capital and Initial Shareholdings on the Company’s Formation section.

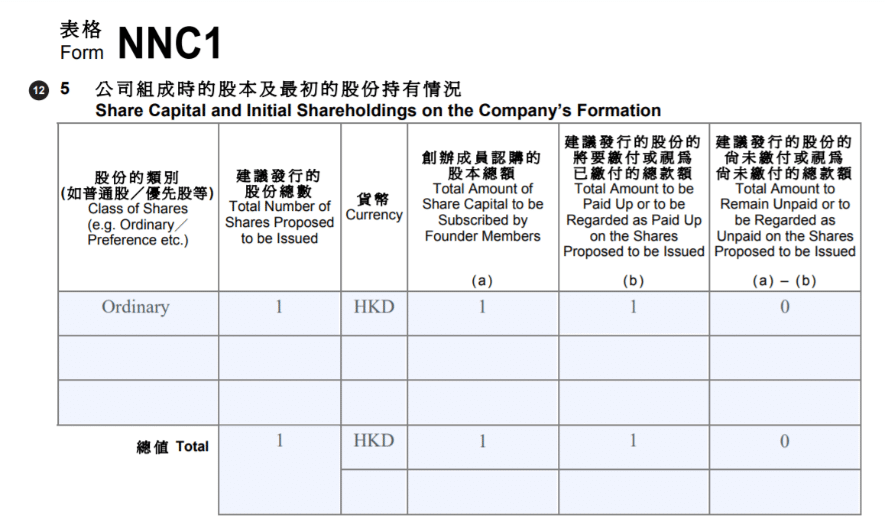

Page 2 of the Incorporation Form NNC1 is about share structure.

The concept of par value (or nominal value) has been officially abolished by the Hong Kong government. However, in practice, most companies still adopt a standard of HK$1 per share as the norm. While shares can technically be denominated in any currency, it is generally recommended to follow the conventional approach of issuing shares at HK$1 each for simplicity and consistency.

In general, the minimum share capital requirement is HK$1. A Hong Kong company must issue at least one share with HK$1 capital. For practical reference, however, the common norm in Hong Kong is to issue 10,000 shares with HK$10,000 capital. While it is legally acceptable to register with only HK$1, such a low capital may give the impression that the company is not genuinely invested. To align with local practice and convey credibility, it is recommended to follow the standard of 10,000 shares at HK$10,000 capital.2.6 Fill in the Founder members and Directors information section

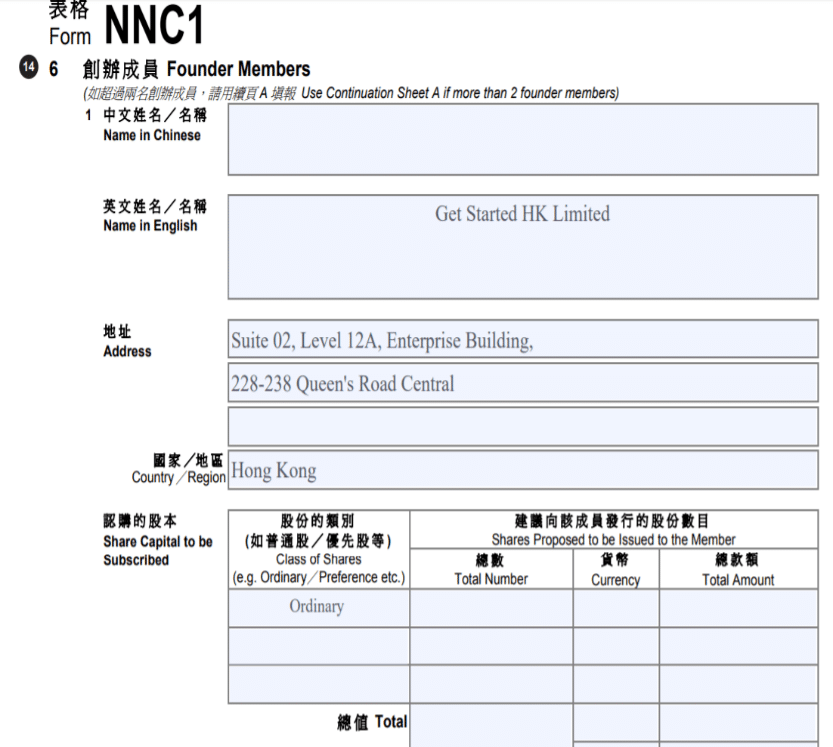

Founder members is referring to shareholders in this application form. Founder members must hold shares of the company. You must write your FULL NAME as it appears on your passport. This includes your middle name if you have one.

Hong Kong has many unspoken cultural rules. One of them is to always write your name in full. This is why when opening a company in Hong Kong, you’re not only doing the logistics, but you also have to know Hong Kong’s do’s and don’ts business culture. In Hong Kong, Chinese names are mostly made up of 3 Chinese characters. We don’t have the concept of a ‘middle name.’ For example, my name is ‘Choi Sun Dou.’ ‘Choi Sun’ is my given name, so you should address me as ‘Choi Sun.’ It would be wrong to address me as ‘Choi’ or ‘Sun’ alone.

When you register a company in Hong Kong, the government officials or financial institutions will also insist you to have your full name on every document even if your middle name is not frequently used. As the saying goes “When in Rome, do as the Romans do.”

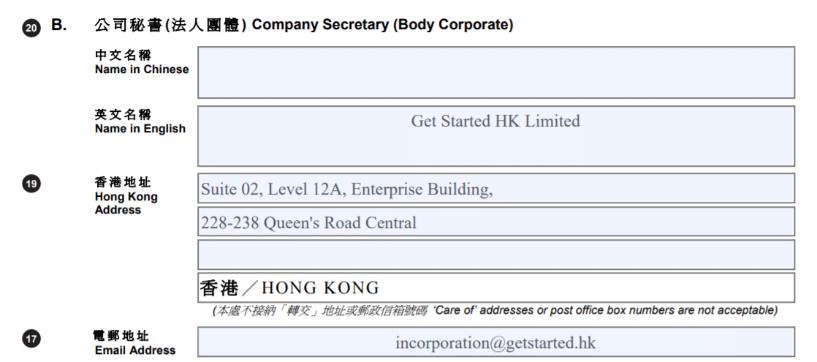

2.7 Fill in the Company Secretary information.

The Company Secretary role is not an administrtaive role, and the role must be handled by a TCSP licensee. This is more than a statutory requirement. A corporate service provider can support a company to operate efficiently. For example, a Hong Kong company must deliver the annual return NAR1 to the Companies Registry every year. The document cannot be filed in advance, but if the company is late for filing, a penalty will apply. It is common for first time business owners to forget the date of filing and end up paying a substantial amount of penalty. Hence, the Hong Kong Government requires every company to appoint a company secretary for compliance.

The Company Secretary role is not an administrtaive role, and the role must be handled by a TCSP licensee. This is more than a statutory requirement. A corporate service provider can support a company to operate efficiently. For example, a Hong Kong company must deliver the annual return NAR1 to the Companies Registry every year. The document cannot be filed in advance, but if the company is late for filing, a penalty will apply. It is common for first time business owners to forget the date of filing and end up paying a substantial amount of penalty. Hence, the Hong Kong Government requires every company to appoint a company secretary for compliance.

2.8 Fill in the Director (Natural Person)

Fill in all the details on page 5. For Residential Address, please note that a P.O. box address is not allowed.

Fill in all the details on page 5. For Residential Address, please note that a P.O. box address is not allowed.

2.9 Fill in the Body Corporate

Notice that the headings for Page 5 & 6 are both listed as “First Directors”. But don’t be confused. Page 5, is for “Natural Person” and Page 6, is for “Body Corporate.” You shall note that a Body Corporate cannot be the sole director of the company. In other words, if there is only one director, you must appoint a natural person as the company director.

Notice that the headings for Page 5 & 6 are both listed as “First Directors”. But don’t be confused. Page 5, is for “Natural Person” and Page 6, is for “Body Corporate.” You shall note that a Body Corporate cannot be the sole director of the company. In other words, if there is only one director, you must appoint a natural person as the company director.

2.10 Don’t forget to tick the appropriate boxes

Most importantly, business owners need to tick the correct box when they sign the consent to act as director of the company. Many foreigners tick both boxes by mistake. If you do so, the application will be rejected. In fact, you should only tick the first box. The second box is only applicable if the director cannot give his consent in this application form.