Most firms charge UPFRONT on accounting, but not us.

Get Started HK runs on solid cashflow and startup-first values. You won't pay a cent for first accounting or audit until 18 months in, when your business is up and running. 🚀 Learn more

Annual Return NAR1 is a mandatory form which a company must file to the Hong Kong Company Registry every year. Government filing fee is HK$105.

A company shall prepare its annual return form NAR1 to the Hong Kong Company Registry every year. The filing due date is within 42 days after the anniversary date of company incorporation. Business owners shall note that no time extension will be given for filing and it is an offence for not delivering the return on time.

Form NAR1 contains all particulars of the company including the details of registered office address, shareholders, directors, shares structure and company secretary. Such form has to be signed by the director, company secretary, managers or authorized representative.

When a company submits its form NAR1, a prescribed government registration fee of HK$105 must also be included on the delivery of the annual return. The filing due date is within 42 days after anniversary date of company incorporation. Sundays and public holidays are also calculated in this 42 days period. Nevertheless, if the 42nd day falls on a Sunday or public holiday, the Hong Kong Company Registry will extend the due date to the following working day which is neither a Sunday nor a public holiday.

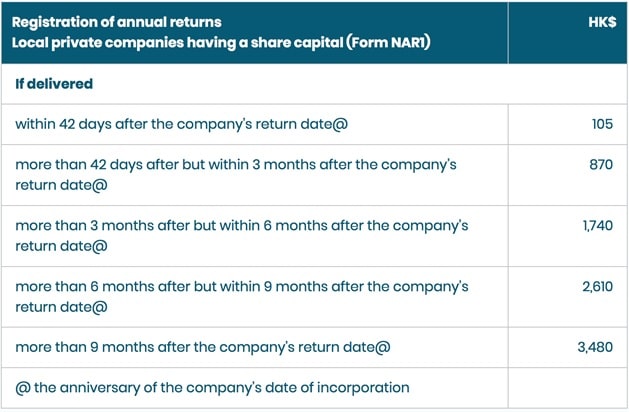

Business owners shall note that no time extension will be given for filing and it is an offence for not delivering the return on time. When the document is delivered late, Registrar will impose different layer of late fee that is up to HK$3480. The Company Registry makes no discretion on the amount of annual registration fees payable.

The registration fee is only HK$105 when the form NAR1 is delivered on time. If the document is a late filing, the registration fee will be up to HK$3480 (refer to Figure A). Company owners who have particular concerns or those who want to save cost and comply with company regulations, you can enroll in our Annual Return e-Reminder Service. This service is included in our deluxe and premium offshore company formation package. We can prepare the form NAR1 for free. So our existing clients need not worry about missing the deadline. You can subscribe for our e-reminder service by contacting our maintenance team at info@getstarted.hk. The service is free of charge and subscribers shall receive an email notification on the anniversary date of incorporation.

While our company maintenance team can prepare and submit documents to the Companies Registry on your behalf, some business owners may choose to deliver documents themselves. Below are twelve important tips we’d remind you during your own filing:

Companies and their administrators are responsible to comply with their obligations to deliver this important form NAR1 to Company Registry under the Companies Ordinance for registration. We highly recommend companies to plan ahead and make their own arrangements (e.g. subscribe our e-Reminder service) to deliver the document on time.

Suite C, Level 7, World Trust Tower, 50 Stanley Street, Central, Hong Kong

See Our Offices