Contents

- Why Hong Kong Companies Need a Certificate of Incumbency

- Who Issues the Certificate and What It Includes

- Situations When You’ll Be Asked to Provide a Certificate of Incumbency

- Key Differences Between Certificate of Incumbency and Other Company Documents

- Step-by-Step: How to Get a Certificate of Incumbency in Hong Kong

- Documents Required to Apply for a Certificate of Incumbency

- How Long It Takes to Obtain the Certificate

- Costs Involved in Getting a Certificate of Incumbency in Hong Kong

- Common Use Cases: Banking, Legal, and International Transactions

- How Often You Need to Update or Renew Your Certificate

- Mistakes to Avoid When Requesting a Certificate of Incumbency

- Do All Companies in Hong Kong Need This Certificate?

- Digital vs. Physical Copies: Which Format Is Accepted?

- Choosing a Reliable Service Provider to Issue the Certificate

What Is a Certificate of Incumbency in Hong Kong?

When doing business across borders or opening a corporate bank account, companies are often asked to prove who is officially authorized to act on their behalf. This is where a certificate of incumbency comes in.

In Hong Kong, a certificate of incumbency is a formal document that verifies the names of a company’s current directors, officers, and in some cases, shareholders. It may also confirm the company’s registered address and legal status. The certificate is typically issued by the company’s registered agent, company secretary, or a corporate service provider.

This document plays an important role in transactions where identity and authority need to be clearly established. For example, a Hong Kong company applying for a bank account abroad may be required to submit a certificate of incumbency to confirm who can legally sign on behalf of the business. Without this document, the process could stall or be denied altogether.

A certificate of incumbency is not issued automatically. It must be requested, and it reflects the most recent records of the company at the time of issuance. While not all local institutions require it, many international entities especially banks, law firms, and compliance teams consider it a critical part of due diligence.

In summary, the certificate acts as an official snapshot of a company’s internal structure. It helps prove legal authority and avoids delays when working with partners, institutions, or regulators who need formal confirmation of who’s in charge.

Why Hong Kong Companies Need a Certificate of Incumbency

Verifying who has legal authority within a company is a routine but critical requirement when dealing with banks, law firms, and overseas partners. Without proper documentation, even basic transactions can be delayed or rejected.

A certificate of incumbency helps Hong Kong companies avoid those roadblocks by serving as formal proof of who holds key positions in the business.

Builds Trust with Banks and Financial Institutions

Banks, especially outside Hong Kong, often ask for this document when opening a corporate account or approving financial transactions. The certificate gives them a verified list of directors or officers authorized to act on behalf of the company. Without it, compliance checks can take longer, or the application may be declined.

Required for Cross-Border Legal and Business Transactions

When signing contracts with foreign partners or entering legal agreements, a certificate of incumbency assures the other party that your company representatives have signing authority. This reduces legal risk and supports faster deal execution.

Supports Regulatory and Compliance Obligations

In some jurisdictions, regulators or auditors may require companies to submit proof of internal structure as part of compliance reviews. A certificate of incumbency provides an up-to-date reference showing who is officially appointed and in what role.

Clarifies Corporate Structure During Ownership Changes

If a company goes through restructuring, changes shareholders, or updates its directorship, the certificate can help demonstrate the current structure clearly. This is especially helpful during mergers, acquisitions, or internal audits.

Useful for Verifying Identity During Legal Disputes

In legal cases where a company’s authority is questioned such as a dispute over a contract the certificate can serve as supporting evidence of who had legal standing at a particular point in time.

In short, this document is more than a formality. It’s a practical tool that helps companies avoid delays, meet compliance requirements, and protect their legal and financial interests during high-stakes processes.

Who Issues the Certificate and What It Includes

When a company is asked to provide a certificate of incumbency, one of the first questions is: Who can legally issue it? This section explains who prepares the certificate in Hong Kong and what information the document typically contains.

Issued by the Company’s Registered Agent or Corporate Service Provider

In Hong Kong, certificates of incumbency are not issued by the Companies Registry. Instead, they are prepared by a company’s registered agent, company secretary, which is often a licensed corporate services provider. These entities are responsible for maintaining up-to-date records on behalf of the company and can confirm its internal structure with formal documentation.

Some companies handle this in-house if they have the proper legal and administrative setup. However, most rely on their service provider especially if the company was incorporated through an agency.

Information Typically Included in the Certificate

While the format can vary slightly by provider, a valid certificate of incumbency usually contains the following:

- Company Name and Registration Number

Verifies the legal identity of the company under Hong Kong law. - Date of Incorporation

Confirms when the company was officially registered. - Registered Office Address

Lists the company’s official address in Hong Kong. - Current Directors and Officers

Names the individuals currently holding official positions, such as director, company secretary, or managing officer. - Shareholder Information (if applicable)

In some cases, especially when required by banks or overseas entities, the certificate may also include details of major shareholders. - Confirmation of Good Standing

Many providers will state that the company is active and in good standing with the Companies Registry as of the date of issue. - Signature and Date

The certificate is signed and dated by the issuing party, often with a company seal or firm stamp.

The content of the certificate should match the company’s latest filings. If there are recent changes such as a new director appointment these should be updated with the Companies Registry before requesting the certificate. Outdated or inaccurate information can lead to delays, especially when dealing with banks or legal professionals.

The certificate of incumbency must be issued by a trusted party and reflect the most current company structure. It acts as a formal confirmation of authority and is often required to move forward with financial or legal procedures.

Situations When You’ll Be Asked to Provide a Certificate of Incumbency

It’s not a document you’ll use every day but when the request comes, timing matters. If your Hong Kong company does business internationally or interacts with financial institutions, you’re likely to be asked for a certificate of incumbency at some point. Knowing when and why can help you prepare in advance and avoid unnecessary delays.

Opening a Corporate Bank Account

Banks, particularly those outside Hong Kong, often require this document to verify who is authorized to act for the company. It gives them a clear picture of the company’s leadership and who can sign legally binding agreements.

Engaging in Cross-Border Contracts

When entering agreements with overseas clients, suppliers, or legal firms, the counterparty may request a certificate of incumbency. This ensures the person signing documents has official authority to represent the business.

Submitting to Regulatory or Legal Reviews

If your company is involved in an audit, court proceeding, or government compliance process, you may be asked to provide proof of current directors and officers. The certificate acts as formal confirmation of the company’s structure at a given point in time.

Applying for International Licenses or Permits

When a company applies for certain licenses such as money services operator (MSO) status, or sector-specific permits in another jurisdiction a certificate of incumbency may be part of the documentation required to support the application.

Onboarding with Payment Gateways or Fintech Platforms

Some online financial service providers request a certificate before activating services. This is especially common with payment processors, trading platforms, and virtual banking tools that require strict identity verification.

Verifying Identity During Ownership Transfers

In business sales or shareholder buyouts, lawyers or due diligence teams may request this certificate to confirm who currently holds control of the company and whether the parties involved in the deal are authorized to act.

Responding to Internal or External Disputes

If a dispute arises over company decisions, having a certificate on hand can help clarify who had legal authority at the time of the contested action helping reduce ambiguity in legal arguments.

A certificate of incumbency isn’t always required, but when it is, the need is usually urgent. Keeping records current and knowing how to request one quickly can make a significant difference when time-sensitive matters arise.

Key Differences Between Certificate of Incumbency and Other Company Documents

Not all company documents serve the same purpose even if they contain similar information. Confusion often arises between the certificate of incumbency and other official records like the business registration certificate, certificate of incorporation, or annual return. Understanding the difference can help ensure you provide the correct paperwork when asked.

Certificate of Incumbency vs. Certificate of Incorporation

The certificate of incorporation proves that a company has been legally registered with the Hong Kong Companies Registry. It shows the date of incorporation and the company’s official name but says nothing about the company’s internal structure.

In contrast, the certificate of incumbency outlines who is currently in charge. It lists the directors, officers, and sometimes shareholders information that’s not included in the certificate of incorporation.

Key distinction:

- Incorporation confirms the company exists.

- Incumbency confirms who runs it.

Certificate of Incumbency vs. Business Registration Certificate

Issued by the Inland Revenue Department, the business registration certificate confirms that a business is registered to operate in Hong Kong and has paid its annual business registration fee. It’s mainly used for local licensing and compliance.

However, it does not verify who holds authority within the company. That’s where the certificate of incumbency comes in.

Key distinction:

- Business registration proves legal operation.

- Incumbency proves management authority.

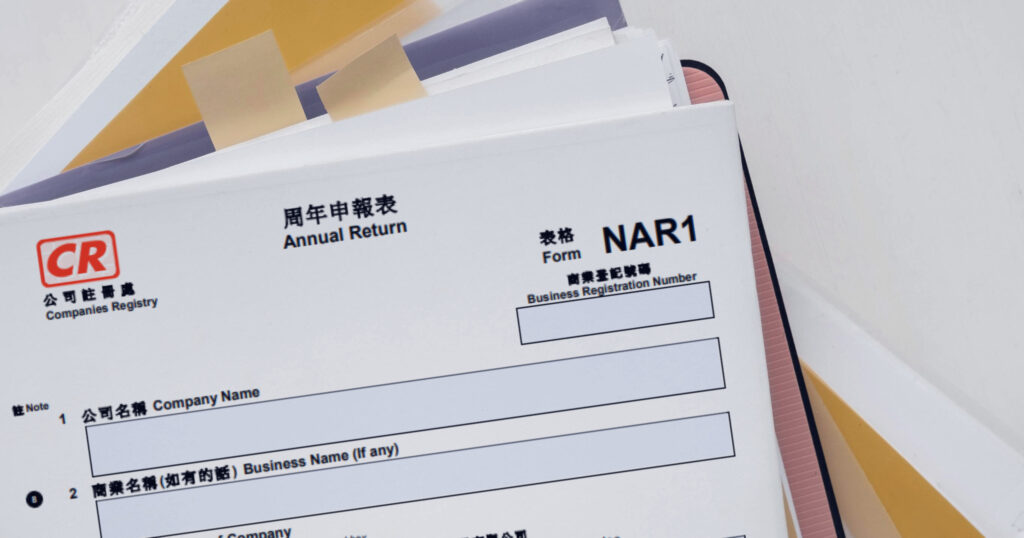

Certificate of Incumbency vs. Annual Return (Form NAR1)

The annual return lists directors, shareholders, and other corporate details as of a specific date each year. It’s filed with the Companies Registry and becomes part of the public record.

The certificate of incumbency, on the other hand, is a private document. It confirms the company’s structure at the time of issuance, not just once per year. It may also be certified or notarized depending on the use case.

Key distinction:

- Annual return is publicly filed and tied to a specific date.

- Incumbency certificate reflects the current structure and is used privately.

When One Document Is Not Enough

Some institutions may ask for more than one type of document. For instance, a bank might want to see the certificate of incorporation, the latest annual return, and a certificate of incumbency. Each serves a different purpose and helps paint a full picture of the company’s identity, legal standing, and internal control.

While several documents can confirm a company’s existence or compliance, only the certificate of incumbency directly identifies who currently holds official positions of authority. Understanding these distinctions ensures you send the right paperwork the first time.

Step-by-Step: How to Get a Certificate of Incumbency in Hong Kong

When a bank, legal team, or foreign business partner asks for a certificate of incumbency, speed and accuracy matter. Fortunately, the process in Hong Kong is straightforward if your company’s records are up to date. This step-by-step guide explains how to request and receive the document with minimal delays.

Step 1: Identify the Right Issuing Party

Start by confirming who can issue the certificate for your company. This is typically:

- Your registered agent

- Your company secretary

- A licensed corporate service provider

If your company was incorporated through an agency, they are usually the best first point of contact.

Step 2: Confirm Your Company Records Are Current

Before the certificate is issued, the service provider will review your company’s latest structure. Ensure that:

- Director and shareholder information is up to date

- Changes have been filed with the Companies Registry

- Business registration and annual return filings are current

If any details are outdated, correct them before proceeding. Delays often happen when internal records don’t match public filings.

Step 3: Submit a Formal Request

Once the information is verified, submit your request in writing. You may need to provide:

- Your company’s name and registration number

- The specific details you need included (e.g., directors only, or directors plus shareholders)

- The purpose of the certificate (e.g., for banking or legal use)

This helps the provider prepare a document tailored to the requirements of the requesting party.

Step 4: Review the Draft for Accuracy

Before the certificate is finalized, your service provider may share a draft. Carefully check:

- Spelling of names

- Job titles and role designations

- Company registration details

- Formatting or signature fields

Inaccurate certificates can be rejected by banks or institutions, so this step matters.

Step 5: Receive and Use the Final Certificate

Once approved, the certificate is signed, dated, and sometimes stamped. You’ll usually receive a digital copy and, if required, a hard copy by courier.

In some cases especially for overseas use you may also request notarization or apostille certification. Make sure to ask in advance if these extras are needed.

Obtaining a certificate of incumbency in Hong Kong is a quick process if your company’s filings are current and the issuing party is experienced. By following these steps, you’ll have what you need to move forward with financial, legal, or international business matters without unnecessary back-and-forth.

Documents Required to Apply for a Certificate of Incumbency

Getting a certificate of incumbency is usually a quick process if you have the right documents ready. Without them, the request may be delayed or returned for clarification. This section outlines the typical paperwork you’ll need to submit when applying for one in Hong Kong.

1. Copy of the Certificate of Incorporation

This confirms your company is registered with the Hong Kong Companies Registry. Most service providers will ask for a scanned copy of this document as a basic check of company identity.

2. Latest Business Registration Certificate

Issued by the Inland Revenue Department, this document shows that your business is currently registered and legally allowed to operate in Hong Kong. The certificate also includes your business registration number and expiry date.

3. Most Recent Annual Return (Form NAR1)

The annual return provides up-to-date details on directors, shareholders, and the company’s registered address. If your latest return hasn’t been filed or is outdated, your service provider may ask you to update it before proceeding.

4. Company’s Articles of Association

While not always required, some providers may ask to see your Articles of Association especially if there’s any uncertainty about director powers or appointment procedures. It helps confirm who is authorized to act on behalf of the company.

5. Identity Documents of Directors or Officers

To support verification, you may be asked for a copy of the passport or Hong Kong ID of each current director or officer listed on the certificate. This is especially important when the certificate will be used in cross-border settings.

6. Proof of Registered Office Address

Some providers ask for recent proof (such as a utility bill or government correspondence) to confirm the registered address remains current. This is more common when records appear outdated or unclear.

7. Authorization Letter (If Requested by a Third Party)

If someone other than a company director is requesting the certificate for example, a legal representative or accountant you may need to provide a signed authorization letter granting them permission to act on behalf of the company.

While the exact list may vary slightly between service providers, having these documents ready ensures a faster turnaround. Double-check that all details are current, accurate, and consistent across filings. This reduces the chance of rework and helps you receive your certificate without delay.

How Long It Takes to Obtain the Certificate

Timing matters especially when you’re under pressure to meet banking deadlines or finalize legal agreements. The good news: getting a certificate of incumbency in Hong Kong is usually fast, provided your records are accurate and your service provider is responsive.

Typical Processing Time

For most requests, the certificate can be issued within 1 to 3 business days. This assumes:

- Your company’s filings with the Companies Registry are up to date

- All required documents are submitted promptly

- The issuing party has no follow-up questions

Some providers may even offer same-day service for an extra fee, particularly if the certificate is urgently needed for bank onboarding or legal submission.

Factors That Can Affect the Timeline

While the process is generally quick, a few issues can cause delays:

- Outdated corporate records: If recent changes to directors or shareholders haven’t been filed, the certificate can’t be issued until updates are complete.

- Missing documents: Incomplete submissions slow down verification and may require back-and-forth communication.

- Requests for notarization or apostille: These add time typically 2 to 10 additional business days, depending on the service provider and delivery method.

- Third-party verification requirements: If the certificate needs to meet specific overseas standards, extra steps may be needed to meet formatting or content expectations.

When to Start the Process

If you’ve been asked to provide a certificate for a specific purpose such as opening a corporate account or submitting legal documents abroad plan ahead. Starting the request at least one week in advance allows time for review, revisions, and delivery without unnecessary stress.

A little preparation goes a long way. Having your documents ready and working with an experienced service provider can ensure your certificate is issued without delays and gets accepted on the first try.

Costs Involved in Getting a Certificate of Incumbency in Hong Kong

For many companies, a certificate of incumbency is requested during urgent banking or legal matters making it important to understand both the timeline and the cost. While the document itself is relatively simple, pricing can vary depending on how it’s prepared, certified, and delivered.

Standard Service Provider Fees

In Hong Kong, most company secretaries or registered agents charge HKD 1,500 to HKD 2,500 for a standard certificate of incumbency. This typically includes:

- Preparation of the document

- Verification of company records

- Issuance of a signed and stamped certificate

The cost may vary slightly based on how detailed the certificate needs to be or how quickly it’s needed.

Additional Charges for Express Service

If you need the certificate urgently, many providers offer same-day or 24-hour service for an extra fee. Expect to pay an additional HKD 1,000 to HKD 1,500 depending on the provider and turnaround time.

Notarization or Apostille Fees

If the certificate is required for use outside Hong Kong especially in jurisdictions that need notarized or apostilled documents extra costs will apply. These services typically add:

- HKD 1,500 to HKD 2,500 for notarization by a Hong Kong solicitor

- HKD 1,500 to HKD 2,000 for apostille service through the High Court

These fees often include processing and courier delivery but can increase with tight deadlines or complex formatting requirements.

Courier and Delivery Costs

Physical delivery of the certificate especially for notarized or apostilled copies may incur courier fees. Local delivery within Hong Kong is usually minimal, but international shipping can range from HKD 300 to HKD 600, depending on the destination.

When Costs Can Increase

You may face higher costs if:

- Your company records are outdated and require filing updates

- Multiple versions or language translations are needed

- You require certificates issued for several related entities or group companies

For most businesses, the total cost to obtain a certificate of incumbency in Hong Kong ranges from HKD 1,500 to HKD 2,000, with additional fees for urgent service, legal certification, or international delivery. Getting your records in order and understanding what’s required upfront can help keep costs predictable and avoid unnecessary delays.

Common Use Cases: Banking, Legal, and International Transactions

A certificate of incumbency is rarely requested for day-to-day business in Hong Kong but it becomes critical when your company is working across borders or handling regulated transactions. Understanding the common use cases can help you prepare in advance and avoid delays during high-stakes processes.

Opening a Bank Account

One of the most frequent scenarios involves setting up a corporate bank account especially with international or digital banks. Financial institutions want confirmation that the person signing account documents is authorized to act on behalf of the company. A certificate of incumbency serves as that proof.

Example: A Hong Kong-based company opening a business account with a bank in Singapore may be required to submit a certificate listing current directors and signatories.

Verifying Authority in Legal Agreements

Law firms and legal departments often request this certificate during contract negotiation, settlement processes, or dispute resolution. It shows who is officially empowered to bind the company in legal agreements.

Example: Before signing a cross-border joint venture agreement, a legal advisor may request the certificate to confirm the named director has the authority to execute the deal.

Meeting Compliance Requirements Abroad

Foreign regulators or partners may request the certificate as part of due diligence or onboarding checks. This is especially true in highly regulated industries like finance, insurance, or digital assets.

Example: A fintech platform based in Europe onboarding a Hong Kong company as a client may require the certificate before granting access to their services.

Applying for Licenses and Permits

Some international licensing authorities or government agencies require companies to present this certificate as part of their application process. It helps confirm the company’s internal structure and the legitimacy of the applicant’s position.

Example: When applying for an import-export license in a foreign jurisdiction, officials may ask for a certificate confirming who holds decision-making power in the applicant company.

Supporting Cross-Border Transactions or Acquisitions

Mergers, acquisitions, and investment deals often involve review of a company’s governance. A certificate of incumbency helps establish transparency during these transactions and is often included in data rooms or due diligence packages.

Example: A private equity firm evaluating a Hong Kong company for acquisition may ask for the certificate to verify that the listed directors match Companies Registry records.

Whether you’re opening a bank account, signing a contract, or applying for an international license, a certificate of incumbency plays a supporting but crucial role. It provides third parties with confidence that they are dealing with the right person and helps your company meet compliance requirements quickly and cleanly.

How Often You Need to Update or Renew Your Certificate

A certificate of incumbency is valid as of the date it’s issued but that doesn’t mean it stays relevant forever. Since company officers or shareholders can change over time, the document may quickly become outdated. Knowing when to update it helps ensure your certificate remains accurate and accepted when needed.

No Fixed Expiry, But Limited Shelf Life

Technically, a certificate of incumbency has no legal expiry date. However, most banks, legal firms, and regulatory bodies treat it as valid for 30 to 90 days from the issue date. After that, many institutions will ask for a fresh copy to ensure the information is still current.

Example: A bank may reject a certificate issued six months ago even if nothing has changed simply because the data hasn’t been officially reconfirmed.

Update After Key Company Changes

Any of the following changes should prompt you to request a new certificate:

- Appointment or resignation of a director

- Change in company secretary

- Alteration of registered office address

- Shareholder updates (if included in your certificate)

- Business reorganization or change in company name

A fresh certificate reflects your company’s structure as of the date it’s issued so it’s important to renew it immediately after internal changes.

Proactive Renewal Before Major Events

If you know a major event is coming such as opening a new bank account, submitting a license application, or entering a foreign contract, order a new certificate a few days in advance. This reduces the risk of delays due to outdated information.

While there’s no set renewal schedule, a certificate of incumbency should be updated anytime key company details change or when a third party requests a copy dated within the past few months. Keeping it current saves time and helps avoid last-minute issues in legal, financial, or international dealings.

Mistakes to Avoid When Requesting a Certificate of Incumbency

A certificate of incumbency is a straightforward document, but small errors during the request process can cause delays or worse, lead to rejection by the receiving institution. Knowing what to avoid can save time and prevent last-minute frustration.

Submitting Outdated Company Information

One of the most common mistakes is requesting a certificate before updating company records with the Hong Kong Companies Registry. If the directors, shareholders, or registered address have changed but haven’t been filed, the issuing provider cannot prepare an accurate certificate.

Tip: Double-check your company’s latest filings before placing a request.

Not Clarifying the Intended Use

A vague or incomplete request may result in a certificate that doesn’t meet your needs. Banks, government offices, and legal teams often have different formatting or content requirements. If these aren’t communicated clearly, the document may need to be reissued.

Tip: Always specify why you need the certificate whether for banking, licensing, or legal purposes so the provider includes the correct details.

Assuming One Certificate Covers Multiple Entities

If your business operates through several Hong Kong companies or subsidiaries, each will need its own certificate of incumbency. A common error is requesting one document to cover a group structure, which isn’t valid for individual compliance checks.

Tip: Request a separate certificate for each legal entity involved in the transaction.

Overlooking Translation or Certification Needs

Some countries or institutions require notarized, apostilled, or translated certificates. Requesting a basic version without planning for these extra steps can delay your timeline.

Tip: Ask early whether notarization or an official translation is required for your target jurisdiction.

Failing to Review the Draft Carefully

Minor spelling mistakes or incorrect titles can render the certificate unusable. Some companies sign and submit the document without checking the draft thoroughly.

Tip: Take time to verify all names, roles, and registration numbers before final approval.

Avoiding common mistakes when requesting a certificate of incumbency is simple if you plan ahead. Keep records current, be clear about the purpose, and take the time to check every detail. This helps you get a certificate that meets the requirements the first time, with no costly back-and-forth.

Do All Companies in Hong Kong Need This Certificate?

If you’re running a company in Hong Kong, you may wonder whether a certificate of incumbency is something you need to maintain regularly. The short answer: not all companies need one but many will at some point.

This section explains who needs it, who doesn’t, and when it becomes a critical document.

Not a Legal Requirement

The certificate of incumbency is not mandated by Hong Kong law. You won’t be fined or penalized for not having one on file. It’s also not automatically issued by the Companies Registry or the Inland Revenue Department.

Instead, it’s a use-on-demand document prepared only when requested by a third party, such as a bank, law firm, or regulator.

Typically Required for Bank Account Opening and Cross-Border Activities

If you plan to open a bank account and you will interact with overseas banks or international clients, you may need a certificate of incumbency.

If your company is involved in:

- Setting up foreign bank accounts

- Applying for international licenses

- Signing legal agreements abroad

- Onboarding with global financial platforms

- Receiving foreign investment

…then the certificate is often requested as part of compliance or verification checks.

Common Among Holding Companies and Offshore Structures

Hong Kong holding companies and businesses with overseas subsidiaries are frequently asked to produce this document. It helps confirm who holds management authority, especially when ownership structures involve multiple jurisdictions.

Startups and SMEs May Not Need It Until They Scale

Early-stage businesses focused on local operations (focus only on the Hong Kong market) typically won’t need a certificate. But as they grow and expand into the international markets, it often becomes necessary especially when attracting international partners or entering regulated industries.

You don’t need a certificate of incumbency unless someone asks for it but when they do, it’s usually urgent. Even though it’s not required for daily operations, it becomes essential during key milestones like banking, licensing, or investment. Knowing how and when to request it ensures you’re ready when the need arises.

Digital vs. Physical Copies: Which Format Is Accepted?

When requesting a certificate of incumbency, one of the most common questions is whether a scanned PDF will do or if a hard copy is required. The answer depends on who’s asking for the document and how they intend to use it.

This section breaks down which format works in which situation and how to decide what to request.

Digital Copies Are Widely Accepted for General Use

In most cases, a PDF version of the certificate is enough. Banks, service providers, and legal firms often accept soft copies via email especially during the early stages of onboarding or review.

Best for:

- Online account applications

- Internal compliance checks

- Initial due diligence or KYC procedures

Digital versions are faster to deliver and more cost-effective. Many service providers issue them by default unless a physical copy is requested.

Physical Copies May Be Required for Legal or Certified Use

Some institutions particularly outside Hong Kong require a hard copy with a wet signature, official stamp, or certification. This is especially true when the certificate will be:

- Notarized by a Hong Kong solicitor

- Apostilled for use in jurisdictions under the Hague Convention

- Submitted to courts, government offices, or foreign regulators

In these cases, the physical version must be shipped and may take a few extra days to prepare and deliver.

Ask Before You Order

The format requirement often comes down to the recipient’s internal policy. A digital copy might be fine for one bank, while another insists on a signed and sealed original.

Practical tip:

If you’re submitting the certificate to a third party, ask upfront whether they need a physical copy, notarization, or apostille. This helps you avoid resubmitting documents later on.

Digital copies are generally accepted for routine business tasks, while physical versions are needed for certified or legal processes. When in doubt, check with the receiving party before placing your order. Choosing the right format the first time helps avoid delays and keeps your transaction moving.

Choosing a Reliable Service Provider to Issue the Certificate

Getting the certificate of incumbency is only as smooth as the service provider you choose. While many licensed firms in Hong Kong offer this service, not all deliver the same speed, accuracy, or support. Choosing the right partner can mean the difference between a quick process and frustrating delays.

Prioritize Firms That Know Your Company

If you already work with a company secretary or registered agent, start there. They have access to your latest filings and are usually best positioned to prepare the certificate without requesting additional paperwork.

Tip: Using your existing provider reduces back-and-forth and speeds up verification.

Check for Company Registry Filing Access

A licensed provider should be able to access and cross-check your information with the Hong Kong Companies Registry. This ensures the certificate reflects current data, not outdated records.

Ask:

- Do they verify against official filings?

- Will they notify you if your filings are incomplete?

Ask About Turnaround Time and Options

Before committing, ask how quickly they can issue the document and whether they offer same-day or next-day service. For urgent matters, this can make a significant difference.

Also confirm:

- Do they offer notarization or apostille services if needed?

- Can they deliver both digital and physical copies?

Read Reviews or Get Referrals

Client feedback can reveal a lot. Look for firms with strong reputations for responsiveness, clear communication, and professional handling of sensitive documents.

If possible, ask a peer or accountant who they’ve used and whether they’d recommend them.

Watch for Hidden Fees

Some providers quote a low base fee, then add unexpected charges for signing, stamping, notarizing, or courier services. Ask for a full breakdown before placing your order.

Checklist:

- Certificate preparation fee

- Extra cost for urgent processing

- Notarization or apostille add-ons

- Courier or overseas shipping charges

Summary

Choosing a reliable service provider means checking more than just the price. Focus on experience, clarity, turnaround time, and support. A good provider helps you get the certificate right the first time saving you time, cost, and compliance trouble.

Image Source: Freepik