Closing a company can be time consuming and exhausting if you are not doing it in a right way in a timely manner. Apart from submitting a series of documents, the deregistration requires to fill in an important application form IR1263, that will be submitted to the Inland Revenue Department with an application fee. The form is to request for a notice of no objection from the Inland Revenue Department to your company being deregistered. The application form may be a bit confusing to complete, but no worries, here is the guideline of how to fill in this application form IR1263.

Step 1: Download the application form IR1263

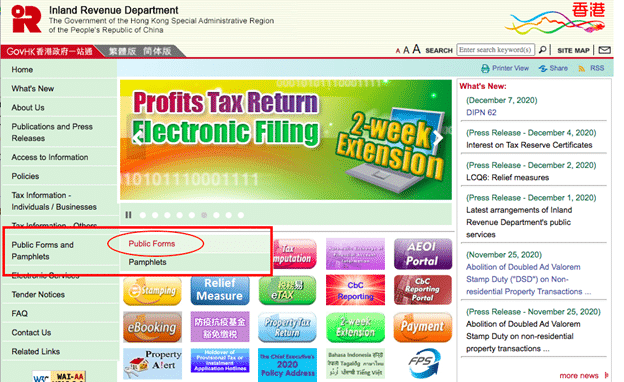

Firstly, you have to download the application form from the website of the Inland Revenue Department.

When you have reached the main page, you can select your preferred language on the top left hand corner below the logo. On the left-hand menu bar, mouse over “Public Forms and Pamphlets” then click “Public Forms” (as shown above encircled in red).

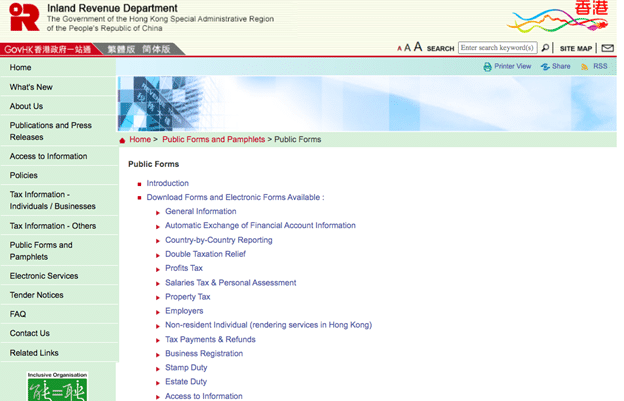

After you click, you will be directed to the page shown as below.

Scroll down to the section “Profit Tax” where you can see a list of forms available to be downloaded in pdf. versions.

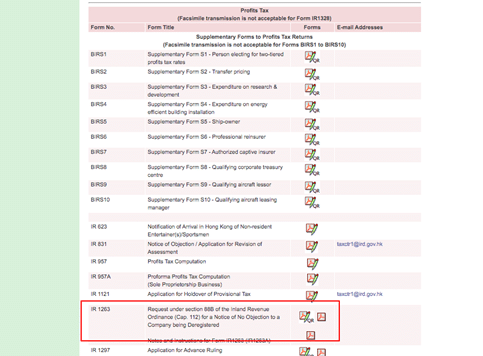

See the column “ IR1263 Request under section 88B of the Inland Revenue Ordinance (Cap. 112) for a Notice of No Objection to be a Company being Deregistated). There are two types of pdf documents. If you have installed the Adobe Acrobat Reader 8 or higher, you may use the fillable pdf form and click the left icon. If you do not, click the icon on the right.

Once you click, the pdf form will be downloaded to your device, then you are ready to fill in the application form.

Step 2. Fill in the application form

In the following section, we will demonstrate how to fill out the application form IR1263. The form is in both Chinese and English. The form is mainly a checklist of Yes/No questions, the answer may look easy, but one mistake can cause troublesome consequences. In the worst case scenario, your application to the no objection status from the Inland Revenue Department will be rejected.

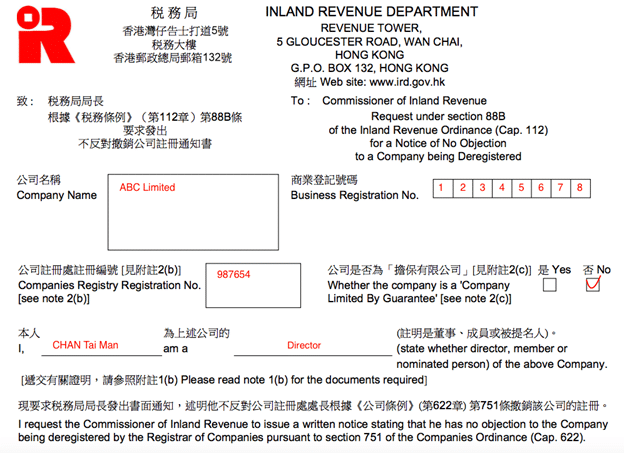

2.1 Fill in the details of your company

Make sure you put the company name and the business registration number that is shown on your valid Business Registration Certificate. The name should be case sensitive. Also, fill in the company number that is shown in the Certificate of Incorporation. If your company is a limited private company, check the box “No”; if you company is a company limited by guarantee, check the box “Yes”.

The full name and the role of the applicant in the company should be filled in. If you are the director, you need not to submit any further documents to the Inland Revenue Department, you can choose the option “director”. If you are a member or a nominated person, you are required to submit an authorization letter signed by the director of the company, then choose the respective answer. You can see the example below.

2.2 Checklist of the company’s information

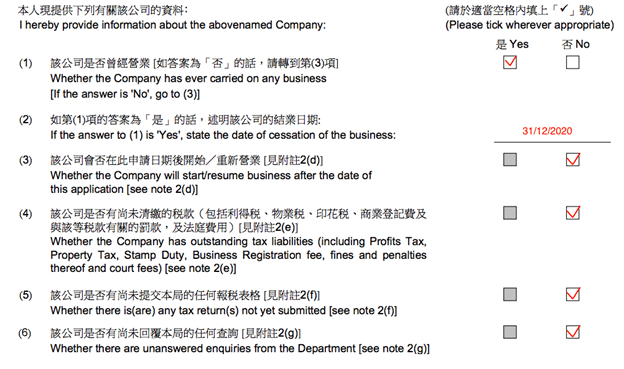

The following section is a checklist of the company’s information, be sure that the information is true and correct, otherwise there would be a huge delay and even a rejection of your application.

For Q1, if your company has ever carried on any business, please tick “Yes” and fill in the date of cessation of the business in Q2. If your company has not carried on any business, please tick “No” and go to Q(3) directly.

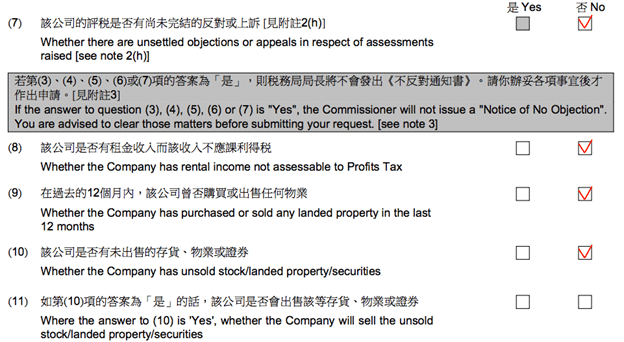

From Q3-Q7, tick the appropriate boxes carefully. If your answer to Q3-7 is “Yes”, your application will be considered rejected thus failing to obtain the “Notice of No Objection” from the Commissioner. You are advised to clear those matters before submitting the application. You may see the example below.

For Q8-11, please tick on the appropriate boxes accordingly. If the answer to Q10 is “No”, the answer to Q11 may be left blank. You can see the example below.

2.3 Detail of the cheque, personal information and signatures of the applicant

Do not forget to include the cheque number of the cheque payable to “The Hong Kong Government Special Administrative Region” for HKD270 as the application fee. If you wish to pay the fee directly to the post office or convenience store, do not write the cheque number in this part.

The last part is to fill in the personal information of the applicant. Date and signature of the applicant should be completed, as well as your mobile phone or office telephone no. If the applicant is a corporate director, or a nominated company, the company chop of the corporate director or the nominated company is required in addition to the signatures. Last but not least, please also include the postal address to be used by the Department for sending subsequent notices (fill in either Chinese or English address only).

Conclusion

Upon the date of lodgment of a valid application and the payment of the prescribed fee, a notification will be expected within 21 working days. The Commissioner of Inland Revenue will issue a notice of no objection to a company if there is no outstanding tax matters and liabilities. A company can only be deregistered if the Inland Revenue Department does not object to the closing of the company. Hence, this application form is of utmost importance.

Please note that the no objection notice is only the first step to close a business in Hong Kong. Apart from the Inland Revenue Department, companies also need to seek consent from the Hong Kong Companies Registry. Applicant has to bring the no objection notice to the Queensway office in Admiralty. A notice must also be published on the Government Gazette. To save time and hassle, you are highly encouraged to seek our professional advice at info@getstarted.hk. We would be happy to help you on the above matter. Thank you for reading.